The collective opinion of investors all around the world is that a diverse investment portfolio is better than a linear one. Diversification is perceived as easy and straightforward by many investors, but truth be told, there is plenty of misleading information out there that might damage numerous of investment portfolios. Of course, you can’t “put all your eggs in one basket” but this is wrongly interpreted by investors. Below we have some additional information that will certainly come in handy when it comes to building a strong and resilient portfolio.

Different Types of Risks Lowe Portfolio Vulnerability

When investing, venture capitalists face two main types of vulnerabilities: undiversifiable and diversifiable.

- Non-diversifiable risks are those that are associated with all companies and all investors. These are commonly known as market risks or systematic risks. In this category fall inflation rates, exchange rates, war, political instability and interest rates. These are things that cannot be changed by the investor themselves and should be accepted as they are.

- Diversifiable risks are also known as unsystematic risks and these don’t depend on political or economic instability. They can be influenced and minimized through diversification and they are specific to companies, markets and industry.

Why Should You Start Diversifying Your Portfolio?

Let’s take a hypothetical situation where an investor only has airline stock investments in their portfolio. The pilots and staff of said airline announce that they will be on an indefinite strike and all stock prices are dropping. Your portfolio will lose its value in an instant.

But if you also have stocks in other industries, let’s say railway stocks, only one part of your investments will suffer. But experts recommend not to stop your diversification at two types of stocks. In case of war or economic instability, both airline and railway stocks might suffer. Diversify your investment portfolio furthermore to gain resilience in face of unfortunate economic or social disasters. From different companies to different industries, investors should seek new diversification opportunities to gain uncorrelated stocks.

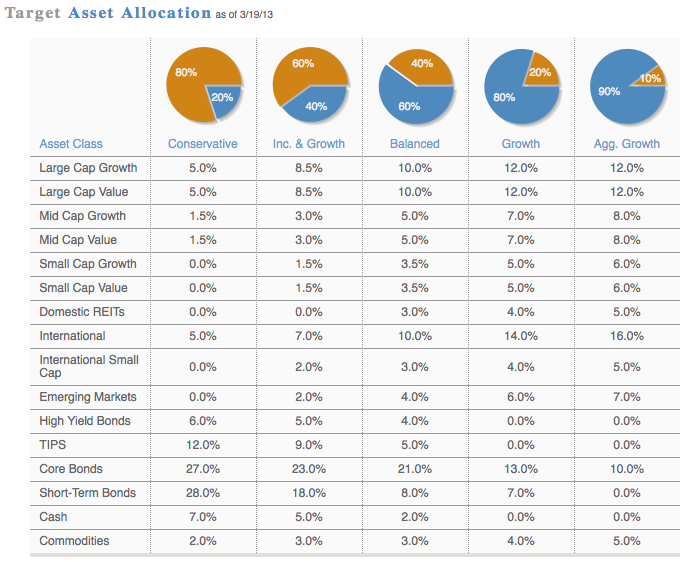

Asset class diversification is also important. Different asset classes react differently to various market events. This type of diversification will keep investors protected against market swings. As a general rule, equity markets and bonds move in opposite directions. So, if unfortunate events emerge in one asset class, the other will experience growth and a positive trend.

Experienced investors can try to diversify their portfolio with synthetic investment products. However, these are complex and require plenty of experience. Small investors and beginners should avoid such investments due to their difficulty level.

How to Find the Finances for Portfolio Diversification?

Diversifying your portfolio means more money invested in different types of assets. If you’re unwilling to swap one asset for another, you can find various types of loans that will offer you just enough financial means for your future investments. Business loans seem to be the most desired when it comes to reliable and accessible financing options for most investors (Source: Nocredit.se). When investors want to reach new diversification rates in their portfolios, these types of loans are the first on investors’ list.

How to Diversify Your Investment Portfolio

To diversify your investment portfolio, it’s mandatory to consider different asset classes. This depends, however, on your capital and risk tolerance.

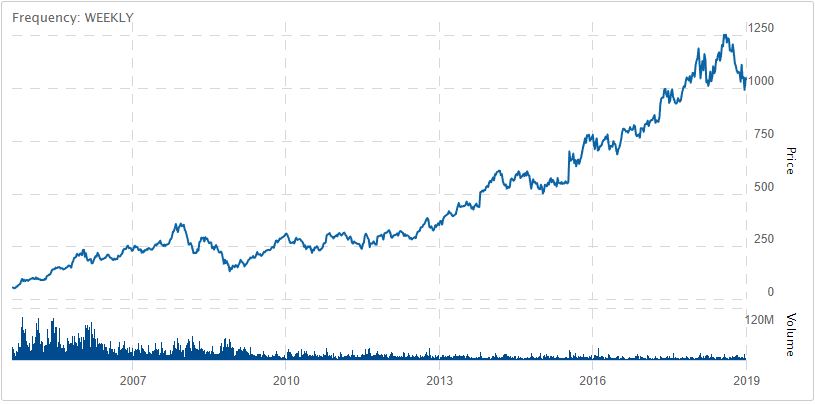

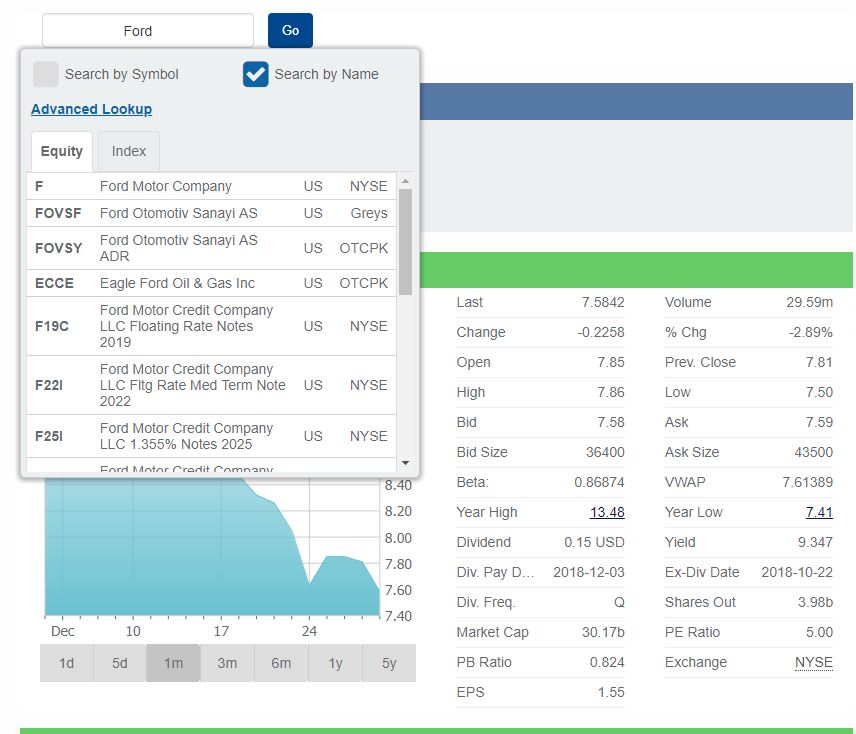

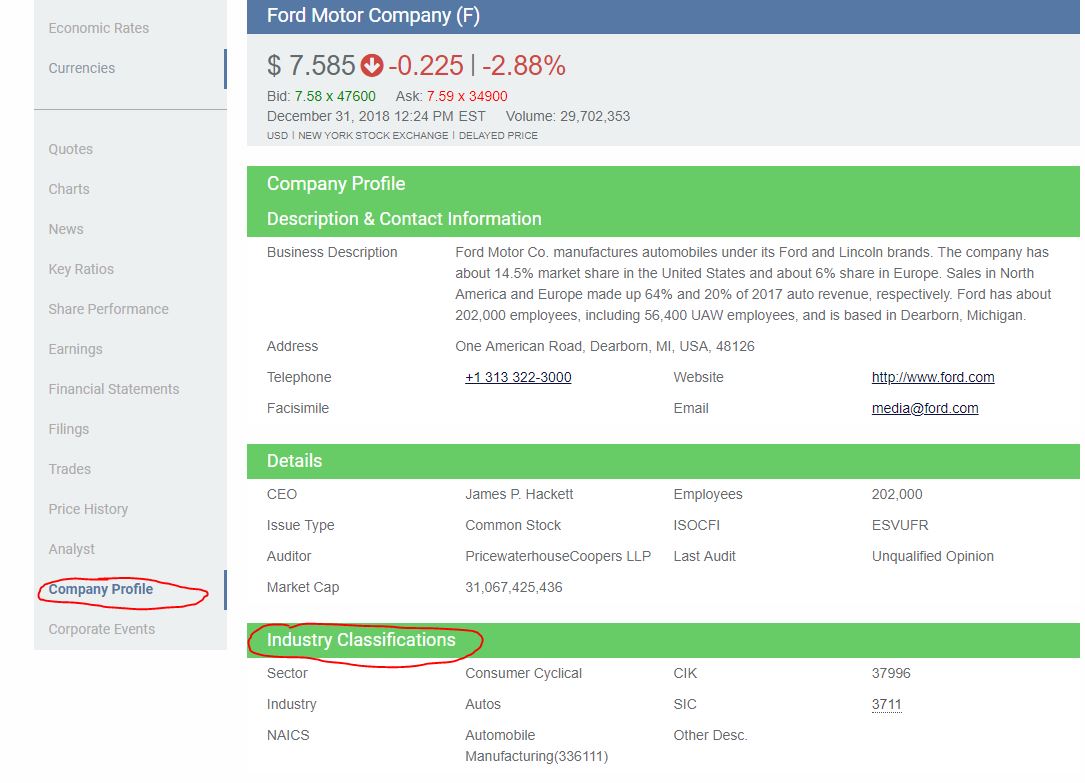

- Stocks are the most common investment option but they also are the most volatile asset class. Instead of investing in stock in a single enterprise, it’s advisable to invest in different enterprises in different industries. Diversity can be achieved easily when it comes to these types of assets, but it’s important not to limit your portfolio at these.

- Real Estate is another asset in which you want to invest for a diversified portfolio. The real estate market and stock market influence each other (see the 2008 recession) but don’t show such a close relationship. When stocks or bonds drop, there is a long interval necessary for real estate to follow. But also, when stock rates experience a positive trend, the housing market needs a while to improve and also follow. When it comes to real estate assets, it’s important to remember that location-specific factors play a huge role in prices to boom or plummet. In this case, you should think of these factors as independent ones from the overall economic context. Expensive markets, for instance, tend to perform better than stock markets in many circumstances.

- Bonds are yet another great type of asset for investors looking forward to diversifying their portfolios. Bonds are issued by government and corporations when they look forward to raising money. Investors can lend money to the government or a company that needs money. The loan is issued for a fixed amount of time and it is also charging interests (variable or fixed). Of course, the borrower will have to repay the entire amount borrowed and interest as well when the bond expires. While this isn’t a permanent type of investment, it’s a great opportunity to diversify one’s portfolio. They perform opposite to stocks in face of various market events, which makes them perfect. Plus, in this case, portfolios are not exposed to market volatility. The amount borrowed will be recovered by its maturity date. Bonds are a great way to counterbalance market volatility and are more stable than stocks and real estate investments are. While the returns are certainly less generous than in other assets’ case, they are a secure investment for sure.

Other Reliable Ways to Diversify a Portfolio

While the options presented above surely are great tools to diversify an investment portfolio, there are other reliable ways to do so. For instance, you can invest in whatever type of asset you think that will accumulate value over time. Vintage cars, art and jewelry are only some of the asset classes that investors believer that will preserve if not boost their value over time. Low-risk short-term investments are other solutions when it comes to portfolio diversification. You could invest in foreign and domestic stocks at the same time to minimize your portfolio’s volatility in face of certain politic and economic events.