We just held our webinar recording for the new features this Fall – if you were not able to attend, you can find a recording here:

Everyone agrees that having a clean slate to work with is the best thing. A clean slate is a perfect way to “smoothly” start towards a fruitful outcome. This “clean slate” is the same reason why creditors and banks often want their debtors to have clean records when it comes to their credit scores.

For one, having a good credit score puts creditors at ease. Creditors will be more likely to trust a person who comes to them with a good credit score. Credit scores are often between 350 to 850. A score of 650 and above means that you’re likely to be more trustworthy. If your score drops to below 650, this is where the problems start.

Having low credit scores can severely hamper your applications. For one, a 2012 study shows that companies use credit checks to hire their employees. Most mobile phone providers also do credit checks and find that an unusual number of people don’t qualify for deals they have. As you can see, having a low or bad credit score can be a bad thing.

Don’t fret. There are ways to help you up that score of yours. Read below to find out how you can gain the trust of your creditors. By the time you religiously follow these facts, you’re well on your way to a good credit score.

It “Pays” to be on time

Don’t mind the play on words, but it does pay to be on time, especially if it’s about paying your bills. Most creditors and lenders are interested in how “on time” are you with paying your bills. Creditors like to look at your payment behaviors because they consider this a good tell of your financial futures.

Hard as it may be, you have to pay your bills on time and in the correct amounts. Bills not only include loans and credit card bills; they also include power bills, phone, and even your rent. If you’re behind payments, resolve them as fast as you can because these can impact your credit scores in the long run.

Old Debts can help

Sure they do help but only if your payments were made timely and without fail. These kinds of debts should be left behind on your credit report. You shouldn’t be hasty in removing these kinds of information off your report. The reasons? These records can help your creditors to see how good and trustworthy you are when it comes to your bills.

Think of it as a positive “Track record” for your payments done in good faith in the past. Don’t worry about having to stick with these records. Proven that you resolved it in time, any debts that have negative consequences to your credit score, are always removed from your report.

Don’t push it

Almost everyone has a credit card nowadays. A credit card is a sort of a “power” or a boost for most people. Although it might be cliche, “with great power, comes with great responsibility” holds very accurate to credit cardholders. Don’t ever exceed your credit card limit as this is one of the red flags that most creditors look at on your credit report.

Carrying multiple credit cards isn’t going to help either. Always be responsible with what you have and don’t impulsively spend on things that may hurt you and your credit score.

Clearing off debts

As mentioned earlier, most creditors often want to work with people who are a “clean slate.” As a debtor, you should always try to clear off debts before applying for any other new loans. If you can’t clear them off entirely, at least try to keep them to a minimum. There are programs from banks or creditors that can help you save money and pay off your debt quickly at the same time.

Balance transfers, for example, can significantly help you pay off that credit card loan. However, do be aware that balance transfers can positively or negatively affect your credit scores, depending on Credit Score Trends that come and go. Always ask and know the intricacies before diving right away into any program.

Getting Professional Help

When you’re downright confused and don’t know what to do about your credit scores, don’t do anything drastic. Always consult a financial expert for some tips and advice on how to positively affect your scores or reports.

Programs do exist wherein a creditor offers them to people to help pay up past debts and loans. The risk with these programs are that most people jump right away at the chance of paying off their debts. What happens is they get to pay off their debts now, while they have to go through complicated processes or even more liability in the future. To avoid any mishaps, always consult with a good financial expert. Don’t be afraid; get help when needed.

Patience is Perfect

If you’ve been up to the task with paying off your debts, then it’s good to relax responsibly now and then. Don’t burden yourself with having to raise your credit score overnight. It’ll happen eventually, just have patience. Don’t rustle through your mind of what could have been and what couldn’t as it’ll only add stress.

Takeaway

A good credit score is what most people nowadays are aiming for. Creditors and you as the debtor alike should know how significant a credit score holds. Keeping a low credit score may not affect you now, but it will in the future. Most debtors don’t bother doing business with people who have terrible credit scores.

If you think that you’re rapidly dropping down to that dreaded credit score, then doing the things mentioned above should help you slow down or even help you raise your credit score.

We live in a hectic digitized world where hacking and data theft are rampant. Every time you connect to the Internet, you become exposed to numerous threats. Cybersecurity is therefore paramount. For a corporation, security breaches may result in immense financial losses.

As a consequence, increasing numbers of companies are enhancing their computer systems with VPNs. There are good reasons to do so, and the benefits are immense. Regardless of the size of your business, unsecured Internet connections may cause trouble.VPNs, the most reliable of which are covered on VPN-review, are a wise solution to the problem.

A virtual private network is a powerful tool to reinforce your digital defenses. They render your connection impenetrable for hackers and safely conceal a user’s actual IP address. Overall, this handy tool ensures solid encryption of data transmission and security of access to any web services and apps.

1. Safe Data Access.

Most businesses nowadays store all kinds of corporate resources in clouds. In the past, all the information was stored in data centers, including software and back-office applications. Now, with things like Dropbox or Google G Suite Business, this scheme is obsolete.

Cloud destinations may contain all customer and employee information, including payroll. Your staff may need to access the cloud for corporate apps. Additionally, when business trips are involved, users have to open those files remotely.

In all cases, the connection should be encrypted and therefore protected from third-party interference. Although cloud storage services often come with a certain degree of protection, it may hardly qualify as comprehensive. A VPN will allow you to boost security without large investments in advanced software. Personalized VPN channels provide staff with secure remote access.

2. No Geographic Blocks.

In countries with tough Internet laws, your traveling employees may be unable to access the resources they need. In China, for instance, even Google is now blocked. A VPN eliminates all kinds of annoying geography-based restrictions. Not only will your staff enjoy the freedom of web search, but they will also access corporate resources and any geo-blocked sites.

This feature also presents a significant benefit of VPN for marketing. If your company is planning to enter foreign markets, it is essential to conduct thorough market research, learning about the tastes and perception of international consumers. Google results, however, as location-based. With VPN engaged, search engines will display results in the same way your target audience sees them. Hence, if you are interested in the preferences of American consumers, you will set your VPN location to the USA.

3. Reduced Costs.

VPNs offer affordable rates incomparable with sophisticated cybersecurity systems. This means a perfect value for money. A VPN will help you boost productivity and security overall, and for a moderate fee.

Most often, you will be charged less than $10 per month, which is negligible for a business. Individual VPN service accounts for all employees are a wise investment, as well as reliable hosting or managed endpoint security.

Unfortunately, being involved in a criminal lawsuit can have a multitude of collateral consequences both in your personal and professional life. As an entrepreneur, what you do in your personal life can also have a huge impact on your business. When you display an unethical behavior, your business will have to suffer too if you fail to manage the situation in a way that protects your business’s reputation.

In the business landscape, protecting your reputation as an entrepreneur is already challenging enough. But with the involvement in a criminal lawsuit, things can become even more difficult. Reputation management both in the online world and among your business contacts is vital in reshaping the public perception about your brand and your capabilities as a business owner.

If you are involved in a criminal lawsuit, protecting your business’s reputation until you prove your innocence will require a solid strategy and a few professionals to help you throughout the process.

Hire a professional criminal defense attorney

There is no other better way to protect your and your business’s reputation than proving your innocence in the criminal lawsuit. Having a criminal conviction will have a huge ripple effect both on your reputation and on your company. Thus, you must ensure that you have a professional legal team on your side to help you prove your innocence or minimize the chance of an arrest.

Hire an experienced criminal defense attorney to help you understand your rights in your situation and to offer you the best legal support in avoiding a conviction. When choosing an attorney, you must see it as an investment for your own good and your company’s good. Only a top-notch attorney will help you fight to prove your innocence and regain your freedom and a clean criminal background.

You are a human before you are an entrepreneur

We are all humans before we are our professions. Mistaking is a very humane thing. However, a mistake you make in your personal life rarely affects your capability to perform at optimal levels in your professional one.

Thus, your customers, business partners, and employees must know that your criminal lawsuit has no consequences on the way you do business. In order to protect your reputation as an entrepreneur and the reputation of your business, you need to show your business contacts the line between you as a person and you as an entrepreneur.

Manage your business’s online reputation

In today’s digital world, your business’s online reputation is paramount for its success. Today’s customers rely on the internet to find and read the reviews and experiences of their peers before making their purchase decisions. when they will look online for your brand, they will most likely find information regarding the lawsuit you are being involved it.

Luckily, you can manage your business’s online reputation with SEO. Search engine optimization is by far the best way to manage the google results your audience will see when searching for your brand. Develop pages that rank when the customers will search for your name or your business. Creating social media accounts will also help your online reputation because the firs results that usually appear when people search on the internet for a business are its social media pages.

Another great way to manage your online reputation is to hire an online reputation management firm. The professionals can help you develop a strategy to manage your online presence in a way that your criminal lawsuit won’t affect your company.

Transform your situation into something good

In today’s labor market, all companies run a background check on the candidates during the recruiting process. Often, although it is illegal, the candidates who have a criminal record are being discriminated and not hired due to this reason.

Having a criminal record doesn’t necessarily mean that you are a bad person or that you are not qualified for the job. Everybody could have made a mistake in their past and it is not morally right to judge them or their capabilities in the present moment depending on that. Thus, it is wrong to judge a candidate based on a criminal record.

When you are being involved in a criminal lawsuit yourself, you can use the situation in the advantage of your business by creating a program that encourages candidates with criminal records to apply to your job. The public opinion is aware of the fact that discriminating someone based on a past mistake is a wrong thing. Thus, if you show empathy to the disadvantaged candidates in the labor market, your business may be seen with better eyes by your customers. Businesses which seem concerned and are willing to get involved in solving hot points for the common good are more willing to be seen with a good eye by the public opinion.

For example, a non-profit organization called Progressive Prison Project, owned by an entrepreneur who himself had a criminal conviction, supports business owners who have been accused of or charged with a criminal offense. This is a good example of how to transform a controversial mistake into something good for your business reputation. You will build a company culture that is against discrimination and promotes acceptance and diversity.

Continue to be a successful entrepreneur

There is probably no worse idea in your situation than to neglect your responsibilities as an entrepreneur. When being involved in a criminal lawsuit, you certainly experience psychological stress and a wide range of negative emotions. However, your business’s success can’t afford you to allow yourself to be distracted and not fulfill your responsibilities. Your customers, business partners, and employees must see your level of professionalism and experience as an entrepreneur even in difficult times.

Bouncing back in the business landscape from your mistakes can be difficult. It takes time, patience, and a powerful strategy to reshape how your business is perceived by the public opinion.

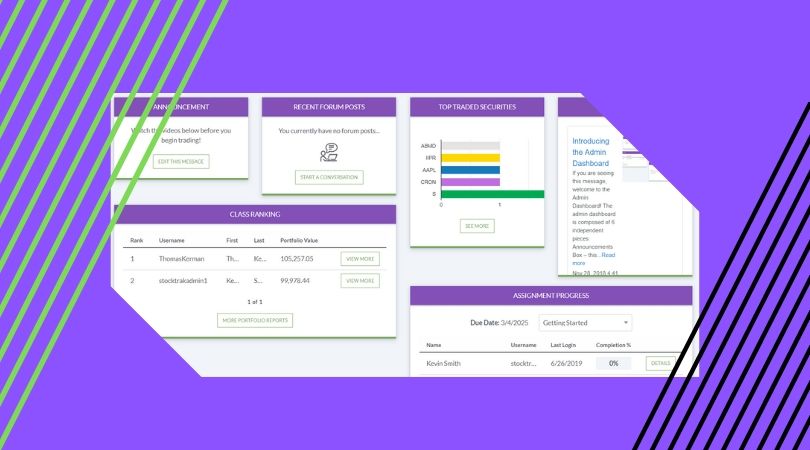

The Fall 2019 semester is almost here, and we’ve been busy over the summer! Here’s a highlight of some of the awesome new features we’ve been working on – with more on the way!

Feature 1: Class Management Report

Is there anything more frustrating than trying to lead a classroom of students who forgot their passwords? Maybe, but at least this will be a thing of the past!

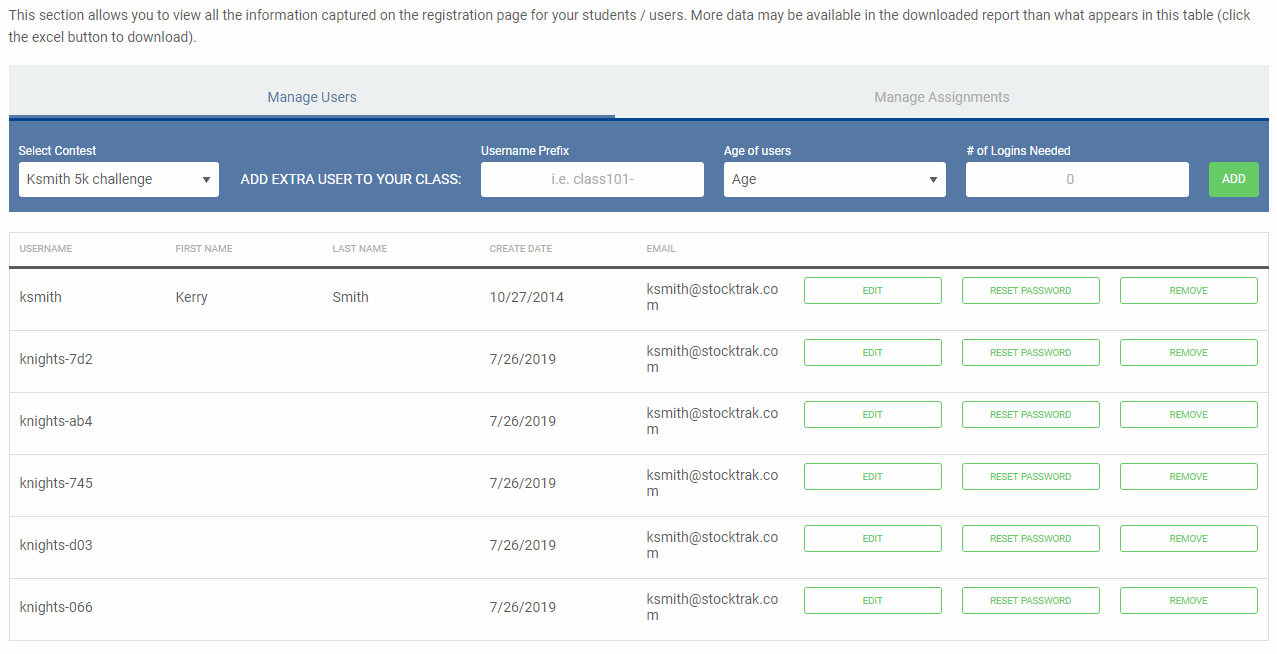

Our new “Manage Users” page is a new report for teachers. You can see a list of every student in your class contest, plus handy administration tools. You can now edit the usernames of every student, and reset any student’s password at any time! This is a new button on your “My Contests” page, right next to your teacher rankings and download buttons.

Feature 2: Generate Accounts

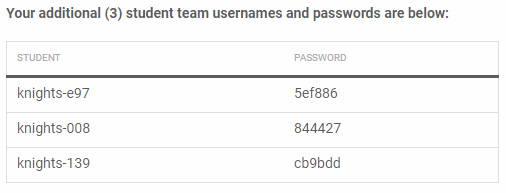

That’s right – we added a whole new way for teachers to get their students added to their class! On HTMW, we always give teachers a registration link to share with their students, then the students pick their own username and password to register. However, not every school wants students to enter their names or email addresses when registering, so we also added in a way for teachers to request logins!

As part of the new “Manage Users” page, teachers can also request student accounts. Just tell us a prefix, and we’ll give you as many usernames and passwords as you need! Distribute them to your students and they can log in and start trading without entering any personal information.

Once the accounts are created, you can then customize each username and reset passwords, just like regular student accounts. How refreshingly easy!

Feature 3: Fewer Ads

Thanks to generous contributions from our sponsors, we were able to remove pop-up ads from HTMW! The site is still supported by advertising, but now is less intrusive for classrooms.

If you are interested in removing ads entirely, and want access to our personal budgeting game, 300+ lesson curriculum library (with built-in assessments), Career and Internship center, Investing101 course, full teacher reports, and revamped student trading, check out our premium version at PersonalFinanceLab.com!

If you haven’t set up your classes for this fall yet, make sure to log in and do it now!

At the early stages of any venture, financing is an ever-present need. Whether you require it to add to the business’s capital or to cater for its daily operations, savings and investor’s money may not always be enough. You will need lending institutions to help with the finances.

Unlike large established companies, a startup is yet to become stable. This means that the venture may be lacking collateral, a credit history, enough cash flow, or proof of its ability to pay back the loan. These are all requirements to get a business loan approved.

You may easily get funds from alternative and small business lenders. But in most cases, small lenders may not provide sufficient funds to meet the business’s needs at such a time of growth.

In the case of startups and small-sized companies and businesses, commercial banks will be keen on the credit rating of the owner to determine whether or not they will lend the business, how much they will lend them, and at what interest rate.

Let’s understand the term credit score, which is also known as a credit rating, and why it is a major player in determining credit qualification.

What is a Credit Rating?

A credit rating is a numerical representation of your ability to pay back a loan. The three-number digit is an indication of the level of risk involved in giving you a loan. A high number shows you are unlikely to default while a low figure shows you are a risky borrower.

The number is computed from data existing from your credit report such as credit history, frequency of applying for credit, balances, and amount of credit used out of the provided limit. Any time you default, make a late payment or file for bankruptcy, there is a drop in the credit score.

So where does the link between personal credit and business credit stem from?

Its Legal Structure

A major distinction between the various forms of business is the liability to loans and other obligations.

In the case of a general partnership and an enterprise that is under sole ownership, the partners or owner are personally liable for all the liabilities the business carries. They can face legal charges for broken contracts, unpaid loans, and debts.

In a limited liability company and corporation, the law in most countries treats the business as an individual, separate from the owners. The business is capable of owning property, suing, and getting sued. In case of default on debt, no action can be taken against the owners, but the entity is held liable.

General partnerships and sole proprietorships are easy to form, and most small businesses take this structure. Lenders, therefore, have to be careful when offering financing to these enterprises. They need to be sure that in case the business is incapable of paying the loan, the owner can step in and make the payments.

A Tie between Enterprise Finances and the Owner’s Finances

Even in cases where the enterprise is legally separate from the owners, the owners get involved in the enterprise’s finances. This is due to the fact that small businesses unlike more established enterprises do not easily access credit from lenders because of the high risk involved.

Here are several situations where personal and business finances are intertwined.

- a) Some owners take up loans under their name to finance the operations of the firm. Due to the firm’s inability to acquire business loans under favorable terms, most owners opt to fund their businesses using home-equity loans. Compared to business loans, home-equity loans and lines of credit are more accessible than business loans.

- b) Consumer credit cards offer an easier alternative for firms to finance their daily operations, and most owners opt for the method. A report by Intuit indicated that small businesses, at the time of the study, owed about $150 billion in consumer credit card debt.

- b) In some cases, lenders request for security in the form of assets. Most startups and small enterprises may lack valuable assets that can adequately act as security. Business owners, in such cases, opt to use personal assets as security for the business loan.

- c) Business owners personally guarantee the unsecured loans that their firms take. A personal guarantee is a promise to pay back a realistic instant cash loans in case the enterprise fails to meet payments. It is a written agreement that allows the lender to pursue the assets of the guarantor in case both the business and guarantor default on payments.

The interconnection between personal finances and a small business’s finances is undeniable. When the business is unable to meet its obligations, the owner steps in. For this reason, the lender needs to be sure that the owner is in a position to adequately cover the debts in case the need arises.

As an enterprise owner, how do you ensure that your credit does not affect the business’s ability to obtain financing?

Improve your Credit Score

Before the business grows and becomes stable, lenders are always going to look at your credit score as a determinant in obtaining credit for your business. As the owner, you can help the business in its financial struggles by ensuring that your score is good enough.

Here is what you should do.

- Pay your bills on time. This includes your student loan debt, auto loans, rent, and utilities.

- Keep the balances on your credit cards low. A low credit balance keeps your credit utilization ratio less than the recommended 30%.

- Check the accuracy of your credit report regularly and dispute any discrepancies you find.

- Do not apply for new credit unnecessarily. It creates hard inquiries that negatively affect your rating.

- Keep the unused credit cards open. It keeps your credit utilization ratio low.

- Let the old debts such as student loan and auto loan remain in your report, but only as long as you made the payments on time and in full. It will increase your score.

Build an identity for Your Business

If your business is a sole proprietorship, incorporate it. It does not just lift the burden of the legal liability off your shoulders, but it also improves the chances of finding new investors.

Obtain a tax identification number, open a new bank account for your new business corporation, a business phone number, and obtain business credit cards.

Work with an attorney to ensure you take all the steps, pay all required fees, and file all necessary paperwork with the right local and state authorities.

In the case of a general partnership, converting the business into a limited liability company is the best option. Changing it into a limited partnership may fail to have the desired result of having no legal liability to the business’s debts. This is due to the fact that at least one general partner is required to run the enterprise.

In case of failure of the business, separating your business and personal credit protects you from losing assets or using personal finances to pay off loans and debts. According to Small Business Association (SBA), half of the small businesses do not survive past the first five years.

Final Words

Small enterprises will always need to borrow credit, and this is the task of banking institutes – to finance these businesses. The only problem is that there is a high risk involved in financing a new business.

For this reason, these lenders will not just check the enterprise’s credit history and performance, but the owner’s as well.

If your personal credit is poor, then the chances of obtaining funds for your venture are low. To prevent this, ensure your credit rating is high and if possible, give legal identity to your business.

By doing this, your credit performance will not affect your enterprise’s financing, and failure of the enterprise will have no adverse impact on personal finances.

You’ve finally made the decision. Your business needs to invest in itself. But this is not just any investment, no. This needs to be an investment that will bring in conversions, something that will notify the public of your business, turn their eyes toward your brand and get their feet in the door. You’ve even decided what you need – some great new signage for your storefront. Not only that, you’re thinking a total rebrand that involves buying all sorts of new signage and graphics for your company. However, your business has been having cashflow issues and you can’t quite scrape together the cash to outright buy something like this.

Of course, you can’t let this stop you, so you need to get the money somewhere. This is the sort of business expenses that you could probably go to a bank or a traditional lender for and get the credit you need in order to make the purchases, hoping that the money you make off of it will be enough to make the payments in time. However, this comes with its own issues. You don’t really want to stretch out your traditional lines of credit, unless you really need to. Likewise, getting a loan from a bank or another traditional lender for something like this is quite time consuming. It can take months just to get approved for the loan. And of course there is the question of getting approved in the first place. There are all sorts of reasons that going to a bank might not be the best decision.

Fortunately, there are other options. Oftentimes, the manufacturers of these products will offer their own financing options to you at significantly simpler terms than a bank would. Since they are the ones selling you the product, they can afford to be a little more generous in the risks that they take, hoping to see you pay them back with the extra money that the signage will generate for your business. They will also often allow several bulk payments for the equipment over a shorter period of time than a traditional loan. Of course, this will only be an option with large orders from some of the larger companies, as smaller companies oftentimes do not have it in their budget to do this and may not be able to fill the order in the first place.

If this option will not work for your business, chances are equipment financing would. These are companies that offer loans to businesses in your position. They usually secure the loan against the equipment you have purchased, that way if you don’t make payments they have something they can recover and at least receive part of their initial investment back with.

Finally, if none of these options will work for you, then chances are you just need to scale back your immediate expectations for this project. Instead of seeing it as an all or nothing, you could purchase some smaller, inexpensive sign options for the beginning of your rebrand and see what the ROI is on those. After they show a positive improvement in sales, you can go on to purchase more signage, having justified your assumptions. There are a number of different types of signage that would work for this. For instance, sintra pvc board is a very inexpensive material that can be custom printed to show whatever your company needs. You can have some printed with your new logo and whatever other branding options you need.

Chances are, there is a solution that will work for your business’ specific situation. All you have to do is be a little flexible and explore all your options. Finding the right partner for your printing needs is essential, as is understanding the terms of any financing options you may pursue. Once you have done all your research and spoken with a number of different companies, you can go forward confidently, knowing you have made the best decision for your company!

For the uninitiated, the term “stock exchange” could paint a picture of a raging bull in their head. After all, they know a little about it and what it exactly plays. You see, the stock market plays an important role in the financial system of the country and can be seen as a vital component for corporate enterprises to function as properly as possible.

What is more, stock exchanges are deemed as quite useful institutions simply because they provide a deluge of services to the investors. If you are planning to begin trading, or you already started with an investment platform, then it is imperative you understand the very fiber of about the stock exchange.

First, let’s talk about what a stock exchange is.

Stock Exchange Explained

By essence, a stock exchange refers to a platform that allows people to trade in financial instruments, such as bonds, shares, or derivatives, among others. Also called a share market, it is where investors can start buying and/or selling incentives. As far as its important functions are concerned, they are listed below:

#1. Marketability of Securities

A stock exchange is basically the very market when it comes to purchasing and selling securities as mentioned above. And since it is more than capable of providing a ready and continuous market for the said unit, the latter can easily be converted into cash – a process that can be done without further delay.

#2. Evaluation of Securities

In stock exchanges, expect all prices of securities to be determined by the demand of investors and the preferences of suppliers. Even more so, they are capable of integrating the very demand and supply of securities, as well as pinpoint their respective prices. This one right here, in case you did not know, is being done on a continuous basis. As far as the prices that are able to prevail in the stock exchanges are concerned, they are called quotations. These quotations, on the other hand, make it possible for investors to have the ability to evaluate the value of their shareholding.

#3. Safety of Investment

There are rules when it comes to how stock exchanges operate, as well as regulations and by-laws. All of these have been created and approved by the government, bounding all members of the stock exchange. Do you know why stock exchanges are more than capable of providing a near-perfect type of market? Well, that is because they are able to make all transactions publicly known to the investors. In addition to this, they can steer clear over trading and speculation by way of having a variety of regulatory measures. These factors, when combined properly, make it possible for stock exchanges to ensure a much greater measure when it comes to safety and fair dealing with the investors.

#4. Facilitates for healthy speculation

It is speculation that always seems to take advantage of fluctuations in price movement. When talking about the securities market, you need healthy speculation in order to be successful in equating demand and supply of securities at various places. Moreover, it is responsible for regulating the prices of securities, a process it is able to perform to a greater extent. The mechanism of stock exchanges is specifically designed to encourage healthy speculation and, as a result, it enables the shrewd investors to quickly gain benefits from price fluctuations.

#5.Capital Formation

Capital formation tends to happen thanks to investments and/or savings. Stock exchanges are basically responsible for facilitating capital formation in the country. Their goal is to create a healthy habit of investing, saving, and even risk-bearing associated and present among all investors. The prices that are being quoted in stock exchanges simply suggest that very extent of companies and their popularity. Investors are then attracted towards companies deemed to be profitable companies; hence, they come forward and decide to invest their savings in the corporate securities. This process, in particular, is what makes it possible for stock exchanges to be successful in facilitating the flow of capital and bring it into more profitable channels.

#6. Regulation and Motivation of Companies

Companies that are looking to list their shares on a stock exchange are expected to follow a set of rules and regulations. For instance, they are all expected to submit any relevant data pertaining to their financial affairs. This information, according to the rules and regulations, must be submitted to the stock exchange on a yearly basis. In other words, companies listed can only safeguard their interest if and only if their financial performance is being monitored closely. That is why the stock exchange is capable of motivating these companies by quoting the prices of securities, especially for those that are hoping to significantly improve their overall financial performance. This also means that the stock exchange is able to bring forth the prevailing business conditions in the country.

Flipping houses seems like it would be a fun and potentially rewarding career, with HGTV glamorizing the idea of flipping homes with all of its popular television shows, such as “Fixer Upper.” However, if you don’t have the necessary skills, licenses, or cash to invest at the start, this pursuit may not be the best idea for you.

Be sure to do some research, considering the qualities a successful house flipper should have before you jump into this exciting endeavor. If you aren’t really familiar with the homebuying process, you’ll want to first review the steps of how to buy a house. You’ll find out more about all the costs associated with that big purchase, including the inspection, the listing process and how to avoid fees as well as how to best be prepared for what might lie ahead and why it’s so important to avoid taking out loans.

In the meantime, ask yourself these questions to determine if you should proceed further.

Are you a realtor or licensed contractor?

A house flipper is usually a professional realtor or a licensed contractor too. If you can be your own realtor, you’ll likely be able to avoid at least some of the potentially high costs associated with purchasing and selling a home. At least a portion of the commission is just one of those costs, and you’ll also be able to host an open house when it’s time to sell and take care of many of the other things that come with the process. If you are a contractor, you can do the work to update the home and avoid paying another contractor to do it for you. Either one of these professions is sure to help you gain the largest possible profits on the property you plan to flip.

Do you have the cash to invest?

Obviously, cash is a big factor. If you don’t have the cash and need to take out a loan, you could end up getting less out of your investment than you put in. If you plan to flip a home, you really must have the cash both to buy it and to fix it up. If you take out a loan to purchase the property, you will pay higher closing costs, which can be up to six percent of the sale price. You’ll also have to pay interest on the loan while you’re fixing it up and while it sits on the market. Both of these costs will dramatically cut into any potential profit.

How comfortable are you with risk?

The real estate market can be a risky business. If you’re used to a lifestyle with consistent and reliable paychecks, you must seriously ask yourself if you would really be comfortable living a lifestyle where money will come and go, and your investments aren’t always secure. Experts typically recommend that you have considerable savings to help get you by in between sales and when the market is slow.

It seems like more and more startup businesses are appearing every year. In today’s business climate, everyone seems to have an idea for what could be the next industry-changing development. Because the internet allows for easier collaboration than ever before, it’s now more possible than ever to start your own business from scratch. But the biggest question a lot of people have when they think about starting their own business is: How do I fund it?

There are actually quite a few different ways you could potentially fund a new business. They all have their own pros and cons, so it can be difficult to determine what the best method is for your particular business. To help you get started, this article will break down a few of the options for funding a business, so you’ll have more information to work with.

Family or Friends

One of the first places you could consider looking for business funding is the people you know best. Family and friends are likely to believe in your cause, and if you know any friends or family members with some cash to spare, this could be a win-win proposition. You could get the funding you need, and if your business takes off, you could repay the friendly investment. Of course, one of the downsides of this approach is that mixing friendly or familial relationships with financial ones can sometimes get messy. One way to make the arrangement potentially better is to come up with a proposition or terms in writing. Even though you’ll be dealing with friends or family, treating the investment like it’s a real business transaction will help clear up any gray areas that may come up down the line. That way, everyone knows and understands the terms that were agreed upon, so it can minimize future disputes.

Government Grants

You may be surprised to learn that the government may be willing to fund your business under the right circumstances. The federal government gives millions of dollars in grants every year, but it’s likely that your business will need to meet some very specific qualifications in order to be considered for a grant. For example, there are grants for:

- Minority-owned businesses

- Women-owned businesses

- Certain nonprofits or charities

- And plenty of other business models

These grants are often designed in an effort to promote greater diversity in the business field. These are just a couple of examples, but you can visit grants.gov to get a more expansive list of the different types of grants that are offered.

Crowdfunding

There are a lot of different crowdfunding websites out there, including GoFundMe, Kickstarter, and other less common options. Crowdfunding has a very high ceiling but also a very low floor when it comes to raising funds. Some crowdfunding sites also have different rules regarding how much of the money you get to keep. Some sites may take a flat percentage off the top, while other sites require you to set a fundraising goal and meet that goal before you get to take any money home. If you fail to meet the goal, usually the money will be returned to the investors. You might also need to offer certain perks or packages to donors to incentivize them. The harsh truth of crowdfunding, however, is that unless your concept goes viral, you probably won’t be able to raise a significantly large sum of cash for your business.

Savings

If you have a good amount of money in your savings, you could consider pulling from your stash to help fund your business. Obviously, like any of the strategies listed here, this comes with its own set of advantages and disadvantages.

- On the plus side, using your own money means you don’t have to sacrifice any ownership stake in your business.

- But of course, the downside is that you’ll have to eat into your own funds. If you don’t have a particularly robust savings account, this tactic may simply not be a viable option.

Angel Investors

Investment firms or wealthy angel investors can be a great way to fund a business, provided you have the connections necessary to pull it off. If you happen to know someone who works at one of these businesses, then that’s a great place to start. But if you don’t have any connections, you’ll need a killer business plan with a lot of research to prove to investors that your business concept is a viable one. Nobody wants to invest in a half-baked business proposal, so make sure to do your work ahead of time if you plan on meeting with large investment firms or venture capital companies.

Online Lenders

With the rise of the internet, online lending is a growing industry that could be a great resource if you’re looking to fund a business. There are services that can connect you with a small business lender, and if you meet the lender’s qualifications, you could get a significant chunk of funds using this strategy. Of course, as with any loan, you’ll want to carefully review the terms before agreeing to borrow money. Failing to pay back a loan on time can negatively impact your credit score or your business credit, so make sure you have a strong budget and plan to pay back the loan, should you decide to go this route.

Banks

Although banks may be less willing to lend money for potential businesses than online lenders are, it may still be worth a try. Working with a bank might be inconvenient in some ways. For example, you may have to wait a long time at the bank for someone to help you, and they may not offer very competitive terms. Even more likely, they may simply decline to approve you altogether. You’ll definitely need a strong business proposal to increase your odds of getting funding through a bank.

Credit Cards

This strategy is not for the risk-averse business owner. Using credit cards to fund your business might seem like a good idea in the short term (and there are success stories of people using this method) but be warned that it could very quickly become damaging. Taking out a large amount of credit card debt puts you at risk of not being able to pay back the debt, which could lead to collections calls, lower credit scores, and other negative consequences. If you need some extra cash for a short-term purchase, a credit card might be the right move, but if you’re thinking about funding an entire business solely on the back of credit card debt, you might want to reconsider. While it’s easy in the short term, it could come back to bite you.

These are just a few of the various possible routes you could go to fund a business. As you can see, there is no one perfect source of business funding. Every option comes with its own benefits and potential downsides. The important thing is to choose a strategy that you are comfortable with, so you don’t end up owing more than you can pay back or damaging relationships along the way. It’s not a decision to be made lightly, so take your time and make the choice that’s best for you and your business.

Luke Loftin is a blog writer and an award-winning indie filmmaker. When he isn’t writing about himself, he specializes in finance and health, blogging about all sorts of topics including credit cards, personal loans, bank accounts, and the digestive system. He currently writes for LeadsMarket among other sites, and his articles are scattered all across the information superhighway. In his spare time, he enjoys listening to country music and watching his favorite sports teams lose. If you want to learn more about him, he doesn’t mind if you search his name on the internet.

Forex trading can be a thrilling activity that provides great opportunities to make money, but it can also be very stressful, especially if you’re very actively trading the market as a day trader does.

What is a day trader? A day trader aims to take advantage of price action fluctuations within a single trading session, closing out all his open positions before the session is over, starting fresh the next day. While day trading can be done in any market, it works best with very liquid markets, like the currency market (also known as the Forex or FX market).

If you want to become a successful Forex day trader, here are a few things you need to understand:

Know what influences the Forex market

You cannot trade the Forex market if you are not aware of the factors that influence currency values. Major Economic Indicators such as the GDP, the CPI, and the Unemployment Rate can help you get an idea of how well a given economy is doing. As these indicators greatly impact the currency market, it is extremely important to follow any economic and financial news and statistics that are scheduled during your trading sessions, as they can trigger higher volatility.

Choose your trading platform according to your needs

Choosing your broker isn’t an easy task, but it’s an essential part of your trading success, as you need to be sure the platform and trading conditions fit your investment style and trading needs. For instance, if you’re a trader using news trading, it would be best to pay fixed spreads, rather than variable spreads. Some brokers, including easyMarkets, do not adjust spreads based on markets conditions, as they believe you need to know in advance how much you will pay to open your trading positions.

Understand leverage and margin trading

Leverage and margin trading are powerful tools, tools you need to use wisely. Leverage magnifies price movements – thus amplifying your profits (and losses). Essentially, leverage allows you to borrow money from your broker. To open a trading position, you only have to put aside a small part of your position – this is called the “margin”. With leverage, you can take advantage of greater market exposure on each trade.

Develop a robust trading plan

While it seems obvious that you should create a trading plan, some traders believe it isn’t necessary to develop a structured method to trade, preferring to trade on instinct. However, the most successful day traders have trading plans, plans that they work on and update continuously.

Use effective money management

Money management rules are fundamental to your trading plan, as it can help you better protect your capital. Here are a few widely followed rules you might want to consider: only trade with money you can afford to lose, invest less than 2% of your total trading capital per trade, adapt the size of your position to the circumstances of each trade, use stop-loss orders, avoid averaging up/down, set a maximum loss per week (after which you take a break from trading), and take advantage of correlation for better portfolio rebalancing and diversification.

Have realistic expectations

Despite what you may think, Forex trading isn’t a get-rich-quick scheme – it takes time, energy and commitment to be a profitable trader over the long run. While trading can a very profitable activity, it isn’t the lottery. Having realistic expectations about how much money you can make, as well as being aware of the money you can lose, will help you move towards your trading goals and be consistently profitable.

Control your emotions

It can be very difficult to think rationally when it comes to trading, as money is on the line. You can easily be influenced by feelings like fear, greed, excitement, frustration or boredom, which can negatively impact your decision-making process. To avoid making any decisions in the heat of the moment, remember to follow your trading plan, no matter what. If you’ve earned (or lost) a lot of money, take a break and stop trading for a while.

You now have all the keys to become a successful Forex day trader, so get started to take advantage of the endless profitable trading opportunities of the Forex market.

Remember to test your trading plan before investing real money, and always protect your capital by following your trading plan and money management rules, and be patient, focused, disciplined and committed. Keeping a trading journal can also be very useful to review your previous trades and adjust trading parameters if needed, so then you can continuously improve your trading results.

Forex market is an amazing platform full of money-making opportunities for seasoned as well as novice traders. However, you should be ready to lose money if you’re not able to handle the basics well. There have been lots of debate by traders on the best approach to prevent loss in the forex market and the ultimate conclusion was that all traders should try to seek basic foreign education before practically entering the forex world.

Forex signals is certainly the first thing every trader should pay attention to as without signals it would become very difficult for the traders to carry out their trades.

The purpose of this post is to highlight the various reasons why forex signals are getting immense popularity in today’s fast-evolving forex world.

Traders Appreciate Signals for Many Reasons

The success of your trades mainly depends on your market proficiency and basic know-how about the forex field. But, it’s not very easy to become a successful trader without any professional help and assistance. Fortunately, market experts and forex gurus are continuously making efforts to explore different approaches, tools and resources that can make the entire trading process fuss-free and easy for them – forex signals being one of them.

Signals Make the Trading Process Easier

Research and analysis is an integral part of forex trading. A forex trader needs to dedicate his time and energy to assess market movements, price actions and other relevant aspects without which sustainability and growth in the forex business wouldn’t be possible. This apparently means you’re left with one option only i.e. to work as a full time trader only. But wait, did you know you can generate continuous flow of passive income for yourself at the same time continuing your regular job or any other side gig? With effective use of forex signals, you can focus on other areas of your business. Since, you’re not required to spend much time analyzing graphs, charts ahead of making a trading decision.

Traders Can Learn How to Trade Better From Signals

Forex signals acts as a learning curve for beginners. Through effective use of forex signals traders can have a better idea about how market changes impacts their investment. Also, the reverse math phenomenon helps trader learn how these forex signals relate to their trade.

By signing up with a legit forex signals company, you can get an opportunity to know about best entry and exit points. In addition to that, you can also get a clear idea about which specific currency pairs can bring about optimum results and profit margins.

Signals Provide a Lower Level of Risk

Risk management is certainly one of the most important aspects that a forex trader cannot take granted for. The more you can handle or minimize your risk, the better results you’ll achieve in the long run. Especially, if you’re a beginner, these signals can give you insightful information about latest forex trends that will help you make better and result-driven trading decisions. Since, forex signals are usually developed and distributed by seasoned traders, the chances of loss is significantly reduced. It’s similar to using services of a professional to play a game on your behalf. Just make sure to acquire services of a reliable and trustworthy provider with a proven success record to ensure you get the best trading results in the end.

Signals Are Run by Professional Traders

It takes years and years of experience and proficiency to know the essentials of forex trade. Even if you’re a pro, you might need to keep yourself updated with latest developments in the forex field to get the most out of it.

Forex signals is a proven and effective way to run your trades while using technical knowledge and proficiency of seasoned traders whose sole objective is to identify market movement, track price changes and hunt down opportunities that crops up in the forex market. By using professional signals service, you can sit back and relax as the most crucial part of research and analysis has already been done by the signal provider.

Knowledgeable Support

Forex signals usually come up with a support service that can be extremely useful if you’re not much aware of the general market rules. Apart from basic help, you can also inquire about things you’re not confident about.

Conclusion

At this stage, you must have a better idea about how forex signals work and why it’s important to seek professional help in today’s fast-moving financial world. The most important aspect you should consider is the quality of signals you’re receiving. This is where your research comes into play. Make sure to invest your money on a company that have reputable image in the financial world. Also, make sure to check out their time zone and channel of delivering signals as without this basic information, it would be difficult to take benefit from the forex signals.

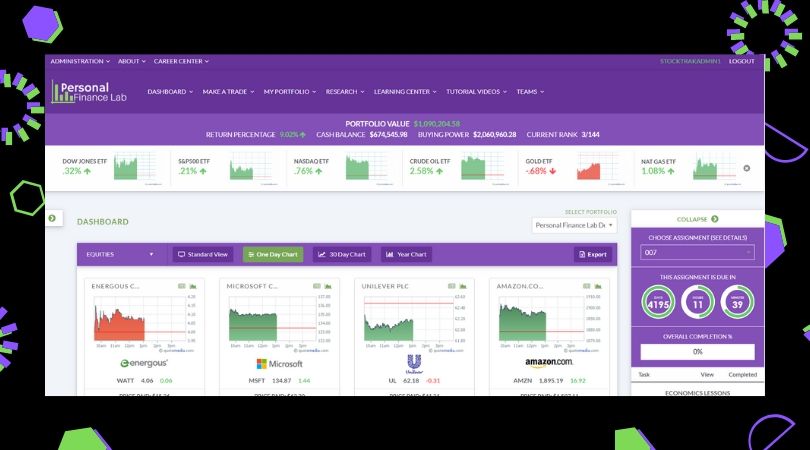

We have worked hard to make HowTheMarketWorks.com is the best free stock market game – and it always will be! But did you know that there is a premium version of HTMW available with even more awesome tools to take your class to a whole new level?

Its true, and its called Personal Finance Lab!

Click the cards below to see the biggest reasons to upgrade to Personal Finance Lab next semester!

[expand id=”ex-ads” title=”No Ads, No Distractions” swaptitle=”Click To Collapse” trigclass=”arrowright”]

No Ads, No Distractions

Our HTMW stock game is open to the public, and supported by advertising. That is great because we can keep it free, but can be a disadvantage for schools. Our Personal Finance Lab version strips away all the advertising – speeding up the site and keeping 100% of the focus on education. Big, chunky spaces for portfolio information (and rankings), more emphasis on assignments, research, and learning, and lightning-fast page loads are some of the first things you’ll notice!

PFinLab is also completely optimized for iPads and chromebooks – with a completely schools-first approach.[/expand]

[expand id=”ex-report” title=”Teacher Reports ” swaptitle=”Click To Collapse” trigclass=”arrowright”]

Teacher Reports

Personal Finance Lab gives teachers a TON of new reports for their classes. See activity charts when students most frequently log in and trade, get the grade books of their quiz progress, or even use the custom report builder to get exactly what you need! You can also reset student passwords, give extra cash for class participation, change usernames, and much, much more![/expand]

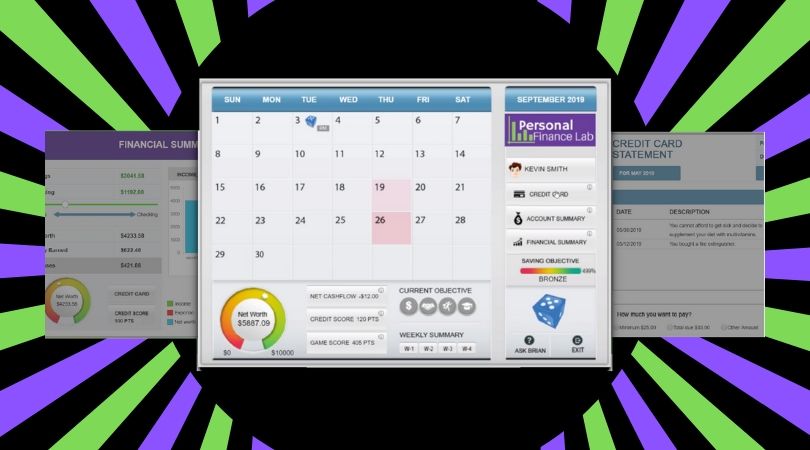

[expand id=”ex-budget” title=”Budgeting Game – NEW! ” swaptitle=”Click To Collapse” trigclass=”arrowright”]

Budgeting Game

New for Fall 2019, the Budgeting Game on Personal Finance Lab is a whole new way to teach about personal budgets and cash flow! The budgeting game puts your student in the role of a college student with a part-time job, working through a simulated year. Each “month” of the game takes about 20 minutes to complete, and students are constantly asked to make decisions that impact their personal finances. The goal of each student is to transfer as much money from checking into savings as possible, maximize their credit score, and make sure they put enough time and effort into school to get their dream job afterwards!

Get more information about the Budgeting Game[/expand]

[expand id=”ex-curr” title=”300+ Lesson, Customizable, Standards-Aligned Curriculum ” swaptitle=”Click To Collapse” trigclass=”arrowright”]

300+ Lesson Customizable, Standards-Aligned Curriculum

If you have ever used Assignments on HTMW, you know how powerful they can be! The Personal Finance Lab curriculum library has over 300 standards-aligned lessons that you can customize for your class. Every lesson includes an assessment with saved grades – with articles, videos, calculators, and much more waiting for your class! Lessons are aligned to both state and national standards for Personal Finance, Economics, Accounting, Management, Marketing, Finance, and Career Development – mix and match for your class!

To make it even better, Personal Finance Lab includes a library of customizable lesson plans, giving teachers ready-made powerpoints, class activities, reading material, group activities, and discussion points for a wide variety of topics across each of our primary subject areas.

See how we align to standards[/expand]

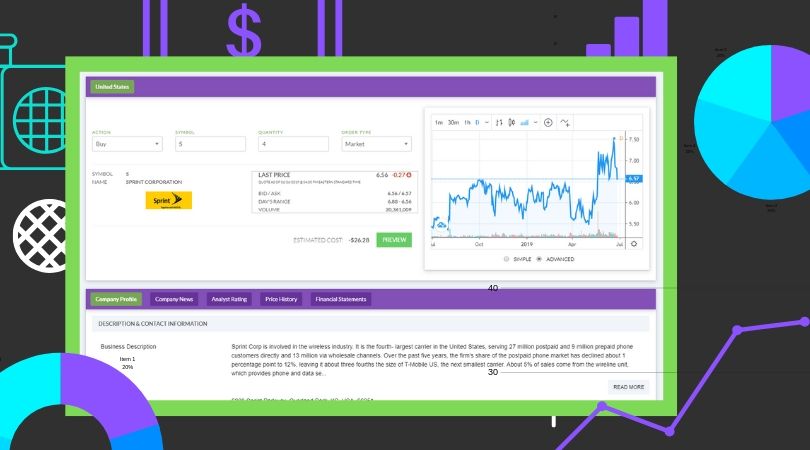

[expand id=”ex-trade” title=”Supercharged Stock Game” swaptitle=”Click To Collapse” trigclass=”arrowright”]

Supercharged Stock Game

This is where it gets really cool – the supercharged trading on Personal Finance Lab is specifically enhanced for use in the classroom. Some of the sweet changes you’ll find include:

- Simple and Advanced chart types – beginner students keep it simple with color codes, while your overachievers can switch over to “advanced” with technical indicators, multiple chart types, and more!

- Built-In Research – Get company profiles, company news, analyst ratings, price history, and financial statements all built right into the trading page. One-stop research depot!

- Faster – No ads, so the pages load and orders execute nearly instantly, every time

- Global – Go beyond North America! Personal Finance Lab lets teachers include international exchanges from Latin America, Europe, Asia, and everywhere else (over 30 countries to choose from)

- Bonds – Personal Finance Lab also includes corporate and treasury bond trading, filling in the 3rd essential portfolio component for beginners.

[/expand]

[expand id=”ex-lab” title=”Integrates With Lab Hardware” swaptitle=”Click To Collapse” trigclass=”arrowright”]

Integrates With Hardware

Personal Finance Lab also integrates with LCD screens and tickers to transform your classroom into a fully-fledged Personal Finance or Business Lab! The PFinLab widget packs can broadcast your class rankings, put in a student-led watchlist, show personal finance, investing, economics, and accounting “words of the day”, currency charts, business news, school announcements, and a LOT more!

Learn more about transforming your classroom[/expand]

[expand id=”ex-price” title=”Pricing” swaptitle=”Click To Collapse” trigclass=”arrowright”]

Pricing

Single Class License (Up To 50 students per year)

- $649 Per Year (Premium Stock Game + Curriculum)

- $995 Including Personal Budgeting Simulation

Micro License (Up To 100 students per year)

- $995 Per Year (Premium Stock Game + Curriculum)

- $1,495 Including Personal Budgeting Simulation

Mini License (Up To 250 students per year)

- $1,995 Per Year (Premium Stock Game + Curriculum)

- $2,995 Including Personal Budgeting Simulation

Full License (Up To 1000 students per year)

- $3,995 Per Year (Premium Stock Game + Curriculum)

- $5,995 Including Personal Budgeting Simulation

Widgets for LCD Screens

- $360 Per Year (For Up To 3 Screens)

[/expand]

Did we pique your interest? Great! Schedule a demo with This Link, and request a quote for your school using the form below!

[col-land]

Nearly every business could achieve more by automating all of the repetitive processes that drain their human capital. These resources would be better directed to tasks that require an expert’s attention, such as high-level monitoring and control.

One significant way to achieve automation is by using VAT software. This software takes over the VAT process by streaming data from ERP systems and other sources. It then processes the VAT while complying with each country’s rules and standards.

Factors to Consider When Researching an Automated VAT Tool

Every company has different VAT needs. A small sized company does not have as high a VAT workload as a multinational company. The latter requires a VAT tool that can stream data from multiple existing systems with ease.

You need to check if the software you’re considering has the features and functions to integrate with the existing accounting software and your operating system. How long and complicated is the procedure of adopting the VAT software into your system?

Always read customer reviews of the VAT tool you intend to implement. It gives you a better idea of what you are getting into. Reviews can provide information on the tool’s ease of use, customer support, and operating system compatibility.

Consider the cost. The additional cost of your VAT solution should be offset by the VAT it reclaims. The best option for many companies is a system that charges small percentage of the recovered VAT. It eliminates the risk of paying upfront and having little gain in the form of recovery.

Why You Should Consider Using VAT Software

VAT technology minimizes errors such as duplicate invoices. When you use software, the automated command repeats the same cycle accurately unlike humans who easily tire, have a low attention span, and make mistakes easily.

Compared to the manual method, an automated VAT system is faster, saving time and making it easier to beat deadlines.

The accuracy and methodology that comes with using a VAT tool enable the tax experts to worry less about the tedious data entry. They can focus on analyzing the VAT spend and taking adequate control of the VAT position.

Tax rules and regulations are always changing. Returning VAT manually could lead to an erroneously missed mark which can cause problems with the tax collection agencies. Using software prevents such headaches by ensuring the process meets every standard.

Wrongly processed VAT can negatively impact other financial reports, leading to complications during audits. Such confusion and embarrassment can be prevented by automating your VAT returns.

With the element of human error removed, you can maximize on net gain. An automated VAT tool uncovers all hidden VAT and processes even the smallest invoices that a human would ignore.

Why take any more risk of losing on your VAT reclaims when you could recover every cent using VAT software?

Adding an automated VAT tool to your system minimizes errors, reduces the risk of non-compliance, saves time, and allows your tax experts to focus on more critical tasks.

To reap these benefits, pick a VAT tool that is cost-effective, easy to use, and well reputed. You are sure to experience a boost in reclaims and a more efficient process.

It is necessary for almost all of us to think in the correct way for some good and decent performance. There will have to be proper executions of the traders to get some good results. At the beginning of the business, we will have to think more about the safety of the trading capital rather than the income because that is the main motto which should be keeping in mind.

Being a novice participant, there will be some defects in the trading setups. The traders will have to work out in the right way for the most proper business preference. With quality, the traders will have to learn about some proper safety to the trading capital. When there is proper learning of the right process, we can expect to get some good performance out of the system. It is necessary for all of us to think like that because too much interest in the profits will take away your capital. That is not good for a proper business performance.

Use the right concepts in there

It is necessary for the traders to learn about the right kind of ideology of trading in Forex. As we talked about, there will not be any kind of good performance in the business without that. We are talking about the simplicity of the trading approaches. For that, the orders will have to be sorted out in the correct way. Then the traders also have to think about some good control of the most proper setting of the lots. Actually, it is in the ordering process of the trades. With some proper thinking, we will have to be minimal with it. Then there is also some proper leverage to the investment needed for the traders. It will help us to be relaxed with the inputs of money. The safety from the losses will also be possible for most of the traders. That is good for all of us in the most proper manner. More things are needed to make your trading approaches right. Just think about the stop-loss and take-profit setups for the right kind of management.

Learn to trade with discipline

It’s true that making a consistent profit is really hard in the Forex market. But this doesn’t mean no one in Hong Kong is leading a life based on the trading profession. If you understand the advanced features of the best trading platform offered by Saxo, you can easily find quality trade setups. Always remember, you need to trade this market with an extreme level of discipline or else you will lose money. Focus on your trade management skills to become a better trader.

Get some proper educations

All of the things we mentioned in the past segment will have to be right on the same side of the setting. The safety precautions will have to be taken with the right kind of approaches. For that, the traders need to learn about some good quality planning. Think about the right ordering process for the trades as we discussed. Then thinking of the most proper closing will also follow the same concept. That is very good for all of the traders. We are going to be right on the edge of getting some proper experience. Thinking and learning about all of the plans and setups will have to be there with the trades. Try out the demo trading sector to enrich your mind with the proper ideas.

Spend time on signal analysis

It is necessary for almost all of the traders to spend some proper time of signals analysis. There will have to be better thinking of all kind of performance. The most legitimate thinking will have to come out when you have proper signals. It will take time for the traders to perfect the process and plans. Even the proper signals will take time to come to us.

With some of the best possible performance, there can be a good income. Even the most volatile marketplace will not be able to stop you. But the right kind of thinking is needed for that. We all need to care for the most proper trading performance in the process. With the right kind of setting, all of the traders need some good patience in the system of some good trading performance. There will have to be the most legitimate performance in the business with all of the trades. The closing positions will have to get the most care out of the bunch. For a novice trader, it may seem too much. But with some time spent in demo trading and the right ideas, there can be good preparation. All of the traders need to worry about the right kind of control of the business. While we are at it, the most proper setting will have to bring some good quality trades from the markets.

Traders need to know about losing

For dealing with the system, all of the traders will need only one thing. We are talking about the most proper control with the right kind of management of the losses. The traders will have to know about the reason behind the losses. There is nothing too much for the traders to care about that knowing about the most common mistakes. It is necessary for traders to be aware of micromanagement or overtrading when attempting to make some good income possible. On the other hand, the traders also think about big inputs into the lots and with the leverage. Some even think about the leverage from the margin trading. It is not right for the most proper business preference to happen. All of the traders will have to come with something right in the process of some good management. The most legitimate setting will have to be there. The traders will have to avoid all of the things we just mentioned.

Stop being an emotional trader

Emotional traders always lose money. Though the term Forex Australia is very popular, very few traders know the proper way to control their emotions. Once you learn to control your emotions, you can easily make consistent profit by trading the market with the elite class broker Rakuten. Stop taking aggressive decisions after losing a few trades. Losing or winning should never bother you. Forget about the outcome of any trade and look for the potential trade setup. Try to trade the market with high-risk reward ratio since it will help to protect your investment.

We all need simple trading accounts

The right kind of account management with the trading money will have to be present. You can think of it is the money management process for the right kind of trading business. To get the most profit with minimal investment, the traders will have to maintain the right plans. The idea behind is nothing but the most proper setting with the right kind of management. There will have to be minimal setups for all of the trades with lots and leverage. We all have to put less money in the trades. With some of the most proper setting in the business. All of the traders will have to work with some good thinking. There are ways to get a good income. Just think about the pips and put less pressure on the actual trading account balance.

Managing the most is good for all

All of the positions of the trades will have to be controlled in the right ways. You can think about the right opening and closing of the trades. Simple setups will be ready with the trading platform. All there is to do is to think about some simple kind of management with the right settings. We are talking about good market analysis.

Affiliate marketing is a lucrative business model that anyone with a computer and Internet connection can do. While it may appear as an easy way to earn income, you still need to invest time, effort, and money to join this industry. That’s why it’s crucial that you do your research and gather information from online resources like journalreview.org – affiliate training courses, or join training programs to gain the knowledge you need for this venture.

Here are the steps on how to start your own affiliate marketing business:

- Select a Niche

Before you start developing an affiliate website, you must choose an industry. This way, your blog has a general theme that can help you find a specific target audience to focus on. While it is possible to be a jack-of-all-trades, it’s much better for your search engine optimization (SEO) strategy to be tied to one niche.

Some questions you can ask when finding a niche are:

- What are the things I currently enjoy?

If this venture is a side hustle for you, it’ll be much easier to see if you can earn money by producing content and promoting products that you’re passionate about. You’re already putting in time for that particular hobby, so it’s sensible to try and earn money from it at the same time.

- What topics am I knowledgeable in?

Another way for you to ease your way into affiliate marketing is by writing about the things that you already know about. These topics can be your passion, as mentioned above, or knowledge that you’ve acquired through your personal and professional experiences.

- Is the niche over-saturated?

Of course, you’re planning to create an affiliate marketing business because you want to earn money. You still need to assess whether the industry has a lot of products that you can promote and a thriving customer base. If you can’t foresee profits from a particular niche, then it’s better to find another one.

- Create a Blog

You need a platform to promote your affiliate products. While you can just use social media channels such as Facebook, Twitter, Instagram, and YouTube, a blog can add authority to your personal brand. You can establish your credibility by ensuring that the products you advertise provides value to your readers and improves their quality of life.

If you have the budget, try purchasing the products you want to advertise first and test them out for yourself. This way, you’ll have first-hand knowledge about the item’s quality so you can provide your readers with a holistic and objective view of the merchandise, as well as set their expectations.

- Sign Up for Affiliate Programs

There are lots of affiliate programs out there that offer high commissions. Online retailers like Amazon and eBay have well-established programs for people who send sales their way. Another advantage of these digital marketplaces is that they offer an expansive array of products, so you can pick the ones that are relevant to your niche.

These are the top affiliate programs today:

- Amazon Associates – A significant advantage of Amazon is that you can get commissions of as much as 10 percent per sale. Moreover, all purchases from the referral link are credited to your affiliate revenue even if the customers bought a different product. One major disadvantage, though, is that their affiliate cookie only lasts for 24 hours.

- eBay Partners – eBay also offers a diverse marketplace with straightforward affiliate sales processes. The downside with its affiliate program is that you won’t earn a cent if an auction goes past ten days even if you were the one who sent the highest bidder to their website.

- Shopify Affiliates – This e-commerce platform focuses on referrals, and you earn a lot per person who signs up, with nearly 600 USD on standard plans and more for enterprise plans. However, your readers must be involved in online selling for them to be attracted to Shopify, which limits the scope of your audience.

- ClickBank – ClickBank is also an extensive database of merchants. It focuses mainly on digital products such as e-books, software, and membership sites. One primary disadvantage with this channel is that there’s a limit of 150 USD of earnings per referral sale.

Conclusion

Anyone can do affiliate marketing. All you need is a computer, Internet connection, and basic writing skills to be able to promote products that you believe in. It’s crucial to remember that you must establish your credibility first and make your readers trust that you’re not just in it for the sales, but that you genuinely want to help them find solutions to their everyday needs.

PEOs come in all shapes and sizes, but one organization that seems to stand out consistently among its competition is Insperity. The company has gained a reputation for itself in the PEO industry as a dedicated, quality-committed, customer service-oriented organization that can serve your PEO needs with care and precision. From payroll to risk management, Insperity has plenty to offer any business looking for PEO services. Here is an honest review of Insperity for 2019. If you’re looking for PEO services in California, you can find a California PEO company on Carefulcents.com.

Flexibility Is Insperity’s Strong Point

One of the best things about Insperity is the company’s ability to customize the PEO experience for specific businesses. Whether you just need payroll and benefits services, or the whole nine yards, Insperity will work to tailor a service package to fit your individual needs.

Pricing

Insperity is a great choice for small businesses looking to alleviate some of the stress of managing things like payroll. With a per employee pricing structure, you’ll be saving plenty of money as opposed to hiring a full-time payroll or HR staff.

Per-employee pricing means you’ll be able to better plan your finances for the coming months without having to worry about surprise fees or costs. Per-employee prices are normally one flat rate for each employee, which again, still amounts to less than the salary for an entire full-time HR staff.

Insperity’s Services

Insperity offers several services for the small business owner. Each of these is tailored to meet your business’s specific needs.

Payroll

Tired of managing payroll and benefits packages? Insperity offers professional payroll management that will not only help minimize errors (and therefore IRS fees) but also keep everything in compliance.

Maintaining compliance is vital to the success of your business. Costly tax fees and non-compliance fees can slow down your growth and hold the business back from its true potential.

HR Services

Recruitment and onboarding are also covered with Insperity. The company will help with hiring new employees, training them, and even developing training materials and handbooks for your company. This makes for one less thing you have to worry about as the owner, leaving time for growing your business.

Risk Management

Every business carries risk, especially if you’re doing business in high-risk industries. With Insperity, you’ll have access to an essential resource for minimizing risk in the workplace. From training programs to workers’ compensation claims and return to work programs, Insperity has you covered. They also offer comprehensive risk-assessments to identify key areas in your business where risk is highest.

Better Benefits Packages

What brings quality candidates to your doorstep? A great benefits package. In fact, benefits packages can mean the difference between high turnover rates and high employee retention rates in small businesses. Providing benefits to your employees lets them know that you find them valuable and that they’re working for a quality organization.

Insperity has the ability to offer some great benefits packages, considering the employees from their various partners are pooled together. The more employees, the better the rates. Benefits such as healthcare will be much cheaper and of higher quality. The only drawback to Insperity’s health options is that they’re provided by one service so the choices can be pretty limited.

…And Many More

To list every one of Insperity’s great benefits would require an article all its own, so we’ve listed only the basic and most widely used services the company offers. Other services include employee scheduling, performance reviews and more. For more information, please visit insperity.com.

Customer Support

Insperity provides excellent customer support staff that are dedicated to ensuring your experience with the company is top-notch. The well-trained support staff includes experts in the fields of human resources, risk management, etc, so you’ll be able to speak with the right person to best answer your question or concern.