| 1 – 100 101 – 200 201 – 300 301 – 400 401 – 500 |

|

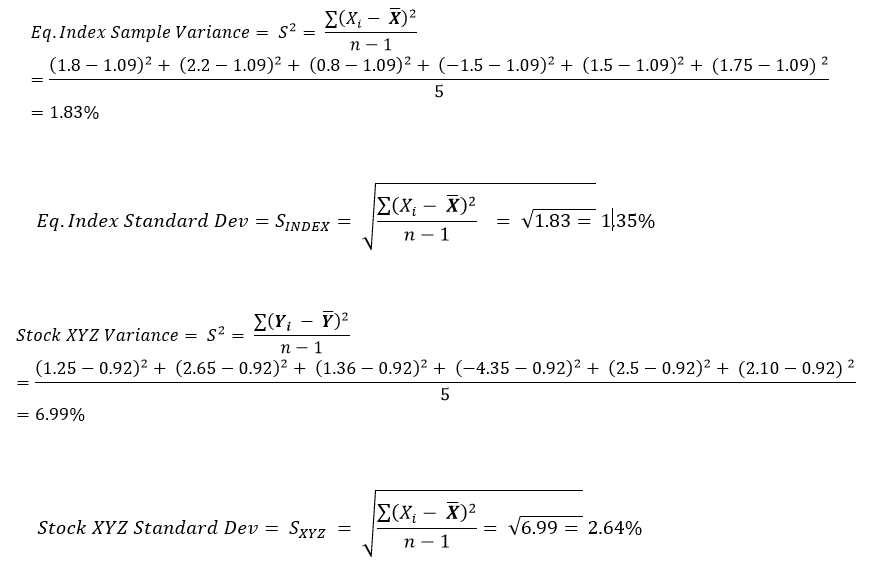

Revenue

|

Profit

|

Profit

|

|||

| Rank | Company | Symbol |

($ millions)

|

($ millions)

|

Margin

|

| 301 | Family Dollar Stores | FDO |

8,547.80

|

388.4

|

4%

|

| 302 | Reynolds American | RAI |

8,541.00

|

1,406.00

|

16%

|

| 303 | Henry Schein | HSIC |

8,530.20

|

367.7

|

4%

|

| 304 | Dover | DOV |

8,501.90

|

895.2

|

10%

|

| 305 | CenterPoint Energy | CNP |

8,450.00

|

1,357.00

|

16%

|

| 306 | Gilead Sciences | GILD |

8,385.40

|

2,803.60

|

33%

|

| 307 | Ashland | ASH |

8,370.00

|

414

|

4%

|

| 308 | Stryker | SYK |

8,307.00

|

1,345.00

|

16%

|

| 309 | Hertz Global Holdings | HTZ |

8,298.40

|

176.2

|

2%

|

| 310 | Assurant | AIZ |

8,272.80

|

545.8

|

6%

|

| 311 | Kinder Morgan | KMP |

8,264.90

|

594.4

|

7%

|

| 312 | Energy Transfer Equity | ETP |

8,240.70

|

309.8

|

3%

|

| 313 | Autoliv | ALV |

8,232.40

|

623.4

|

7%

|

| 314 | Republic Services | RSG |

8,192.90

|

589.2

|

7%

|

| 315 | Reliance Steel & Aluminum | RS |

8,134.70

|

343.8

|

4%

|

| 316 | Peabody Energy | BTU |

8,096.00

|

957.7

|

11%

|

| 317 | Great Atlantic & Pacific Tea |

8,078.50

|

-598.6

|

-7%

|

|

| 318 | W.W. Grainger | GWW |

8,078.20

|

658.4

|

8%

|

| 319 | Goodrich |

8,074.90

|

810.4

|

10%

|

|

| 320 | AutoZone | AZO |

8,073.00

|

849

|

10%

|

| 321 | Visteon | VC |

8,047.00

|

80

|

0%

|

| 322 | AECOM Technology | ACM |

8,037.40

|

275.8

|

3%

|

| 323 | Steel Dynamics | STLD |

7,997.50

|

278.1

|

3%

|

| 324 | Coca-Cola Enterprises | KO |

7,939.00

|

749

|

9%

|

| 325 | Williams Companies | WMB |

7,930.00

|

376

|

4%

|

| 326 | Commercial Metals | CMC |

7,919.80

|

-129.6

|

-1%

|

| 327 | Hormel Foods | HRL |

7,895.10

|

474.2

|

6%

|

| 328 | Corning | GLW |

7,890.00

|

2,805.00

|

35%

|

| 329 | TravelCenters of America | TA |

7,888.90

|

23.6

|

0%

|

| 330 | Sonic Automotive | SAH |

7,871.30

|

76.3

|

0%

|

| 331 | MGM Resorts International | MGM |

7,849.30

|

3,114.60

|

39%

|

| 332 | Thrivent Financial for Lutherans | PRIVATE |

7,842.80

|

454.6

|

5%

|

| 333 | Becton Dickinson | BDX |

7,832.10

|

1,271.00

|

16%

|

| 334 | Campbell Soup | CPB |

7,719.00

|

805

|

10%

|

| 335 | Boston Scientific | BSX |

7,622.00

|

441

|

5%

|

| 336 | Dana Holding | DAN |

7,592.00

|

219

|

2%

|

| 337 | Oshkosh | OSK |

7,584.70

|

273.4

|

3%

|

| 338 | Masco Corporation | MAS |

7,560.00

|

-575

|

-7%

|

| 339 | Universal Health Services | UHS |

7,534.10

|

398.2

|

5%

|

| 340 | Ameren | AEE |

7,531.00

|

519

|

6%

|

| 341 | Quest Diagnostics | DGX |

7,510.50

|

470.6

|

6%

|

| 342 | Darden Restaurants | DRI |

7,500.20

|

476.3

|

6%

|

| 343 | Regions Financial | RF |

7,427.00

|

-215

|

-2%

|

| 344 | Broadcom | BRCM |

7,389.00

|

927

|

12%

|

| 345 | Owens-Illinois | OI |

7,358.00

|

-510

|

-6%

|

| 346 | Eastman Chemical | EMN |

7,283.00

|

696

|

9%

|

| 347 | The Pantry, Inc. | PTRY |

7,271.80

|

9.8

|

0%

|

| 348 | Cablevision Systems | CVC |

7,252.30

|

291.9

|

4%

|

| 349 | Dole Food | DOLE |

7,223.80

|

38.4

|

0%

|

| 350 | Tenneco | TEN |

7,205.00

|

157

|

2%

|

| 351 | Charter Communications | CHTR |

7,204.00

|

-369

|

-5%

|

| 352 | Spectrum Group International | SPGZ |

7,203.40

|

3.8

|

0%

|

| 353 | Franklin Resources | BEN |

7,140.00

|

1,923.60

|

26%

|

| 354 | OfficeMax | OMX |

7,121.20

|

34.9

|

0%

|

| 355 | BorgWarner | BWA |

7,114.70

|

550.1

|

7%

|

| 356 | Alpha Natural Resources | ANR |

7,109.20

|

-677.4

|

-9%

|

| 357 | Energy Future Holdings | PRIVATE |

7,040.00

|

-1,913.00

|

-27%

|

| 358 | Interpublic Group | IPG |

7,014.60

|

532.3

|

7%

|

| 359 | DaVita | DVA |

6,998.90

|

478

|

6%

|

| 360 | Barnes & Noble | BKS |

6,998.60

|

-73.9

|

-1%

|

| 361 | Targa Resources | TRGP |

6,994.50

|

30.7

|

0%

|

| 362 | Cameron International | CAM |

6,959.00

|

521.9

|

7%

|

| 363 | Winn-Dixie Stores | WINN |

6,929.90

|

-70.1

|

-1%

|

| 364 | Calpine | CPN |

6,800.00

|

-190

|

-2%

|

| 365 | Ecolab | ECL |

6,798.50

|

462.5

|

6%

|

| 366 | Cliffs Natural Resources | CLF |

6,794.30

|

1,619.10

|

23%

|

| 367 | Avery Dennison | AVY |

6,786.70

|

190.1

|

2%

|

| 368 | Celanese | CE |

6,763.00

|

607

|

8%

|

| 369 | NII Holdings | NIHD |

6,719.30

|

198.8

|

2%

|

| 370 | MasterCard | MA |

6,714.00

|

1,906.00

|

28%

|

| 371 | Jarden | JAH |

6,679.90

|

204.7

|

3%

|

| 372 | Fifth Third Bancorp | FITB |

6,673.00

|

1,297.00

|

19%

|

| 373 | Dollar Tree | DLTR |

6,630.50

|

488.3

|

7%

|

| 374 | Weyerhaeuser | WY |

6,618.00

|

331

|

5%

|

| 375 | Agilent Technologies | A |

6,615.00

|

1,012.00

|

15%

|

| 376 | Sanmina-SCI | SANM |

6,602.40

|

68.9

|

1%

|

| 377 | NuStar Energy | NS |

6,575.30

|

221.5

|

3%

|

| 378 | Advanced Micro Devices | AMD |

6,568.00

|

491

|

7%

|

| 379 | Terex | TEX |

6,504.60

|

45.2

|

0%

|

| 380 | CMS Energy | CMS |

6,503.00

|

415

|

6%

|

| 381 | AK Steel Holding | AKS |

6,468.00

|

-155.6

|

-2%

|

| 382 | American Family Insurance Group | PRIVATE |

6,400.20

|

295.2

|

4%

|

| 383 | Dillard’s | DDS |

6,399.80

|

463.9

|

7%

|

| 384 | McGraw-Hill | MHP |

6,336.00

|

911

|

14%

|

| 385 | Amerigroup | AGP |

6,318.40

|

195.6

|

3%

|

| 386 | Anixter International | AXE |

6,270.10

|

188.2

|

3%

|

| 387 | Precision Castparts | PCP |

6,267.20

|

1,013.50

|

16%

|

| 388 | Mattel | MAT |

6,266.00

|

768.5

|

12%

|

| 389 | Omnicare | OCR |

6,239.90

|

86.9

|

1%

|

| 390 | Corn Products International |

6,219.40

|

415.7

|

6%

|

|

| 391 | Symantec | SYMC |

6,190.00

|

597

|

9%

|

| 392 | Advance Auto Parts | AAP |

6,170.50

|

394.7

|

6%

|

| 393 | Core-Mark Holding | CORE |

6,163.40

|

26.2

|

0%

|

| 394 | CC Media Holdings | CCMO |

6,161.40

|

-302.1

|

-4%

|

| 395 | Expeditors International of Washington | EXPD |

6,150.50

|

385.7

|

6%

|

| 396 | Mylan | MYL |

6,129.80

|

536.8

|

8%

|

| 397 | Wesco International | WCC |

6,125.70

|

196.3

|

3%

|

| 398 | Cognizant Technology Solutions | CTSH |

6,121.20

|

883.6

|

14%

|

| 399 | Consol Energy | CNX |

6,117.20

|

632.5

|

10%

|

| 400 | PetSmart | PETM |

6,113.30

|

290.2

|

4%

|

| 1 – 100 101 – 200 201 – 300 301 – 400 401 – 500 |

Refers to a form of insurance policy which includes a broad range of coverage or protection.

Refers to a form of insurance policy which includes a broad range of coverage or protection.

The Chicago Board of Trade (CBOT) is a publicly-traded exchange (NYSE: BOT) that specializes in futures and options trading.

The Chicago Board of Trade (CBOT) is a publicly-traded exchange (NYSE: BOT) that specializes in futures and options trading.

Capital funding are monetary resources provided to another party for business (or non-business) purposes.

Capital funding are monetary resources provided to another party for business (or non-business) purposes.

A Commercial Bank is a type of financial institution that is responsible for catering to everyday banking needs.

A Commercial Bank is a type of financial institution that is responsible for catering to everyday banking needs. But what happens when you break that trust? What happens if you do not pay, even the minimum amount, when you are required to pay?

But what happens when you break that trust? What happens if you do not pay, even the minimum amount, when you are required to pay? WeSeed.com, a stock market game for educators and their students, will officially close on August 31, 2013.

WeSeed.com, a stock market game for educators and their students, will officially close on August 31, 2013.