Actually, one of the better indicators historically of how well the stock market will do is just a Gallup poll, when you ask Americans if you think it’s a good time to invest in stocks, except it goes the opposite direction of what you would expect. When the markets going up, it in fact makes it more prone toward decline.

Belgium’s Main Industries

Belgium is economically known for its strength in:

- Diamonds

- Industrial and Manufacturing Sector

- Engineering and Metal Products

- Minerals Processing

- Copper

- Zinc

- Lead

- Minerals Processing

- Steel and Iron Production

- Engineering and Metal Products

- Heavy machinery and industrial equipment production

- Motor and Vehicle Assembly and Production

- Automobiles

- Ships and vessels

- Petroleum

- Food and Beverage Processing

- Chemicals and Pharmaceuticals

- Sulphuric Acid

- Nitric Acid

- Synthetic Ammonia

- Crude Tar

- Textiles Processing

- Cotton

- Wool

- Linens

- Synthetic Fabrics

- Spinning

- Weaving

Belgium’s Main Stock Exchange

The main stock exchange in Belgium is:

- 1. Euronext Brussels

- Founded in the early 19th century

- Merged with the ParisBourse and Amsterdam Exchanges to form Euronext

- Euronext provides a single, cross-border exchange for markets in equities and derivatives

- Main Index

i. BEL 20 – includes twenty highly liquid Belgian equities

Belgium is an important trading partner with many EU members, and as such, many companies in the EU region have also listed on the Euronext Brussels.

Glimpse into Belgium’s Equity Market

Belgium listed equities have rebounded following the 2008 financial crisis yielding around 30% from recessionary bottoms, as represented the BEL 20 index.

The Euronext Brussels market capitalization rose 17% from Euro 202 billion (2009) to Euro 273 billion (2010).

Stock Index Performance: BEL 20 Index

Belgium’s 10 Most Profitable Companies in 2010

Ways to Invest in Belgium

There are a couple of different ways to invest in Belgian companies:

- Financial or Investment firms

- Brokerage services are provided by domestic or international firms in Belgium

- Through a regional Belgian bank

- Belgian banks offer securities investment services

- AXA Bank

- KBC Bank

- BNP Paribas Fortis

- Argenta

- Belgian ETFs

- EWK:NYSE ARCE – tracks the MSCI Belgium Investable Market Index

- Through some international online brokers:

- MB Trading

- Interactive Brokers

- TD Ameritrade

- E-Trade

- Questrade

- optionsXpress

- optionshouse

- tradeMONSTER

- Charles Schwab

- Belgian banks offer securities investment services

Italy’s Main Industries

Italy is economically known for its strength in:

- Agriculture Sector

- Maize corn

- Olive Oil

- Fruits and Vegetables

- Flowers

- Wine

- Meat

- Dairy Products

- Services

- Financial

- Banking

- Insurance

- Asset Management

- Financial

- Tourism

- Precious metals

- gold

- Industrial and Manufacturing

- Iron and Steel

- Chemicals

- Machinery

- Automotives

- Precision Engineering

- Textiles and CLothing

Italy’s Main Stock Exchanges

The main stock exchange in Italy is:

- 1. Borsa Italiana

- Founded in 1808 and operated under state ownership until privatisation in 1997

- In 2007 was purchased by the London Stock Exchange

- Serves trading in equities, and plays an important role in Italy’s fixed income and derivatives market

- Some Indices

i. FTSE/MIB Index

ii. MIBTel

Glimpse into Italy’s Equity Market

Foreign equity investors have remained cautious, with investment inflows not being significant in 2010. Italy’s equities have been considerably impacted by the Euro-zone debt and default crisis, and amid an uncertain economic outlook, with the stock index down 12% during the 2010 year.

Market capitalization of stocks has been stable, increasing from $317 billion in 2009 to $318 billion in 2010.

Italy’s 10 Most Profitable Companies in 2010

Ways to Invest in Italy

There are a couple of different ways to invest in Italian companies:

- Through Italian Banks or foreign ones located in Italy

- Banca d’Italia

- Banco di Roma

- Intesa Sanpaolo

- Banca delle Marche

- Canadian ETFs

- EWI: NYSEArca – tracks the MSCI Italy Index

- Through some international online brokers:

- MB Trading

- Interactive Brokers

- TD Ameritrade

- E-Trade

- Questrade

- optionsXpress

- optionshouse

- tradeMONSTER

- Charles Schwab

Ireland’s Main Industries

Ireland is economically known for its strength in:

- Agriculture Sector

- Cattle

- Beef

- Dairy

- Services Sector

- Financial

- Banking

- Asset Management

- Financial

- Tourism

- Mining and Metals Sector

- Zinc

- Lead concentrates

- Alumina

- Coal

- Gypsum

- Limestone

- Industrial and Manufacturing Sector

- Construction Sector

- Residential property

- Construction Sector

- Pharmaceuticals and Chemicals

- Technology Sector

- Hardware

- Software related goods and services

- Energy Sector

- Supply and distribution of natural gas

- Electricity

- Coal

Ireland’s Main Stock Exchanges

The main stock exchange in Ireland is:

- 1. Irish Stock Exchange

- Founded in 1793 and is Ireland’s sole independently-owned exchange

- Has an established and extensive debt securities trading market

- Operates three principal markets

i. Securities of established domestic and global Irish companies

ii. Growth-oriented companies

iii. Debt market

- Indices

i. ISEQ Overall Index

Glimpse into Ireland’s Equity Market

Irish equities experienced negative returns following the 2008 economic crisis. With the Irish banking sector have a heavily credit exposure to a deteriorating and crashing property market, the economy underwent significant problems.

The 3-year return on the ISEQ overall index was -48%. The index has somewhat recovered however, with the last 9 months yielding 4.5%

Ireland’s 10 Most Profitable Companies in 2010

Ways to Invest in Ireland

There are a couple of different ways to invest in Irish companies:

- Irish Banks of foreign banks/investment companies in Ireland

- Allied Irish Banks

- Anglo Irish Bank

- Bank of America

- DePfa Bank

- KBC Bank Ireland

- Rabobank Ireland

- Goldman Sachs Bank (Europe)

- Irish ETFs

- EIRL:NYSEArce – seeks to track the MSCI Ireland Capped Investable Market Index

- EKH:NYSEArce aims to allow diversification through the performance of some of the largest European companies listed on the US market (has some exposure to Irish companies)

- Through some international online brokers:

- MB Trading

- Interactive Brokers

- TD Ameritrade

- E-Trade

- Questrade

- optionsXpress

- optionshouse

- tradeMONSTER

- Charles Schwab

Hungary’s Main Industries

Hungary is economically known for its strength in:

- Agriculture Sector

- Wheat

- Corn

- Sunflower

- Potato

- Sugar beet

- Canola

- Apple

- Pear

- Grape

- Wine

- Livestock

- Industrial and Manufacturing Sector

- Automobile Production

- Engine manufacturing and production

- Vehicle Assembly

- Automobile Production

- Heavy Industry

- Mining and Metallurgy

- Metalworking and processing

- Steel Production

- Metallurgy

- Machine Production

- Machine tools

- Transport Equipment

- Electrical Appliances

- Mining and Metallurgy

- Energy Production

- Mechanical Engineering

- Chemicals

- Food Processing

- Services

- Tourism

Hungary’s Main Stock Exchange

The main stock exchanges in Hungary is:

- 1. Budapest Stock Exchange

- Previously The Hungarian Stock Exchange (1864)

- Operates as a subsidiary of the CEESEG AG holding company, which owns around 70% of the BSE

- Over 40 domestic and international brokers participate in trading on the BSE

- Products traded include

i. Equities

ii. ETFs

iii. Government and corporate debt

iv. MBS

v. Futures and options

vi. Grain commodities

- Important indices

i. BUX

ii. MSCI Hungary Index

Glimpse into Hungary’s Equity Market

Hungary’s economy was severely impacted by the recent recession, owing partly to having one of the largest public deficits in the EU region. However, it has recovered quite well, and its equities have rebounded solidly over the past year.

The MSCI Hungary Index stock index rose 24.36% over the last year, with a year-to-date of 16.59% return.

Stock Index Performance: BUX

Hungary’s 10 Most Profitable Companies in 2010

Ways to Invest in Hungary

There are a couple of different ways to invest in Hungarian companies:

- Through a regional Hungarian Bank or a foreign bank/investment company located in Greece

- Erste Bank Hungary

- Budapest Hitel

- OTP Bank

- Deutsche Bank

- BNP Paribas Hungaria Bank

- Raiffeisen Bank

- Investors can purchase equities through a regional bank

- Hungarian ETFs

- ESR:NYSEArca – tracks the MSCI Emerging Markets Eastern European Index Fund

- GUR – aims to replicate the SPDR S&P Emerging Europe index, and has over 5% exposure to Hungary

- Through some international online brokers:

- MB Trading

- Interactive Brokers

- TD Ameritrade

- E-Trade

- Questrade

- optionsXpress

- optionshouse

- tradeMONSTER

- Charles Schwab

Peru’s Main Industries

Peru is economically known for its strength in:

- Agriculture Sector

- Fishing

- Artichokes, grapes, avocadoes, mangoes,

- Cotton

- Coffee

- Sugar

- Services Sector

- Tourism

- Natural Resources

- Copper

- Gold

- Silver

- Petroleum

- Timber

- Iron ore

- Coal

- Natural gas

- Mining Sector

- Gold

- Coal

- Copper

- Zinc

- Silver

- Iron Ore

- Manufacturing and Industrial Sector

- Metal mechanics

- Tobacco processing

- Food processing

- Textile

Peru’s Main Stock Exchanges

The main stock exchange in Peru is:

- 1. Bolsa de Valores y Productos de Asunción (BVPASA)

- Established in 1977 and is Peru’s only stock exchange

- Exchange provides trading services in equities and debt securities of both public and private companies

- Stock Index

i. IGBVL index

Glimpse into Peru’s Equity Market

Prior to the global financial crisis in 2008, Peru experienced economic growth that was among the top-performers in Latin America (2007 and 2008). Political stability and liberalised economic policies have made Peru a very open investment regime, attracting significant foreign investment and capital

Equities performed exceptionally well in 2009 and 2010, with the IGBVL index rising 101% and 65%, respectively. Between the same periods, the market capitalization of its exchange grew by 43% from $US 69.7 billion to $US 99.8 billion.

Peru’s 10 Most Profitable Companies in 2010

Ways to Invest in Peru

There are a couple of different ways to invest in Peruvian companies:

- Through a Peruvian Bank or foreign one located in Peru

- BBVA Banco Continental

- Banco Financiero del Peru

- Bank of Nova Scotia

- JP Morgan Chase Bank

- Banco Standard Chartered

- Citibank

- Peruvian ETFs

- EPU:NYSEArca – Peruvian ETF that tracks the MSCI ALL Peru Capped Index

- Through some international online brokers:

- MB Trading

- Interactive Brokers

- TD Ameritrade

- E-Trade

- Questrade

- optionsXpress

- optionshouse

- tradeMONSTER

- Charles Schwab

Portugal is an EU member country with a high-income and service-based economy. It enjoys vast forests, has a strong industrial base, and is an important agricultural exporter.

Portugal’s Main Industries

Portugal is economically known for its strength in:

- Agriculture and Fishing Sector

- Cereals

- Olives

- Wheat

- Maize

- Wine

- Oranges

- Fish

- Industrial and Manufacturing Sector

- Oil refining

- Cement production

- Machinery and electronics

- Textile and footwear

- Food processing

- Forestry Sector

- Pulp

- Paper

- Services Sector

- Tourism

- Transport

- Telecommunication

- Financial

- Banking

- Natural Resources Sector

- Lithium

- Tungsten

- Tin

- Uranium

Portugal’s Main Stock Exchanges

The two main stock exchanges in Portugal by size are:

- 1. Euronext Lisbon

- Created in 1769 as the Lisbon Stock Exchange

- Acquired in 2002 by Euronext NV to become Euronext Lisbon. It became part of the NYSE Euronext Group following their merger in 2007

- Trading occurs mainly in equities, bonds, warrants, ETFs, and derivatives

- Index

i. PSI-20 – composed of Portugal’s 20 largest companies by market cap and share volume

- 2. OPEX

- An alternative trading system (ATS) geared for trading in small and medium sized Portuguese companies

- Listing criteria is not very rigid and regulated

- Specializes in alternative investments and securities such as

i. Warrants and certificates

ii. Derivatives

- Investors include private equity investors, hedge funds, and pension funds

Glimpse into Portugal’s Equity Market

The performance of Portuguese equities has been heavily impacted by the Euro-zone peripheral economies’ debt crisis, as well as its own. The Market capitalization of its exchange fell by 17% in 2010 to $81.9 billion, and its equities have significantly underperformed during the last 3 years with a -30% return.

Investor capital and equity outflows have been considerable during this period, and investment should be limited with the current uncertain outlook. Portugal has recently negotiated a $110 billion bailout from the EU and IMF.

Ways to Invest in Portugal

There are a couple of different ways to invest in Portuguese companies:

- Through a regional Portuguese Bank

- Portuguese banks enable their clients to invest in securities listed on the exchange

- Banco Espirito Santo

- Banco Comercial Portugues (BCP)

- ETFs with exposure to Portugal

- CUT:NYSEArca – tracks the Beacon Global Timber Index

- DFE:NYSEArca – tracks the WisdomTree Europe SmallCap Dividend Index

- Through some international online brokers:

- MB Trading

- Interactive Brokers

- TD Ameritrade

- E-Trade

- Questrade

- optionsXpress

- optionshouse

- tradeMONSTER

- Charles Schwab

- Portuguese banks enable their clients to invest in securities listed on the exchange

Romania is an EU member country, which has experienced positive foreign direct investment and GDP growth following privatization initiatives over the last decade. It has an upper-middle income economy strong in its industrial and agricultural sectors.

Romania’s Main Stock Exchanges

The two main stock exchanges in Romania by size are:

1. Bucharest Stock Exchange

It was founded in 1882 and has merged with Romania’s OTC exchange (RASDAQ) in 2005.

The principle securities traded on this exchange include:

- Equities

- Government and Corporate debt

- Fund units

- Structured products

2. SIBEX

It is Romania’s second largest exchange, and is designed for trading in derivative securities such as futures and options on

- Stocks and indexes

- Currencies

- Interest rates

- Commodities such as gold

Glimpse into Romania’s Equity Market

Romania’s major index is the BET, which is composed of Romania’s 10 largest listed companies.

Romanian equities yielded positive returns of 16% during the last year, and have performed solidly relative to other European equities.

Market cap of listed equities increased 7% from $US 30.3 billion in 2009 to $US 32.3 billion in 2010.

Stock Index Performance: BET 20

Romania’s 10 Most Profitable Companies

Ways to Invest in Romania

There are a couple of different ways to invest in Romanian companies:

1. Through a bank in Romania

- Banca Tanssilvania

- Romanian International Bank

- CEC Bank

- Alpha Bank

- ABN Amro

- Raiffeisen Bank

- Citibank Romania

- Libra Bank

2. ETFs

ESR:NYSEArce – It is an emerging markets ETF with high exposure to Eastern Europe

Austria’s Main Industries

Austria is economically known for its strength in:

- Services Sector

- Financial

- Banking

- Asset management

- Law

- Financial

- Tourism

- Industrial and Manufacturing Sector

- Metals Production

- Iron

- Steel

- Metals Production

- Machinery

- Electric

- Electronic

- Equipment

- Chemicals and Petro-Chemicals

- Synthetic textile fabrics

- Pesticides

- Pharmaceuticals

- Plastics

- Textiles

- Embroidery

- Spinning

- Weaving

- Knitting

- Forestry Sector

- Pulp

- Paper

- Mining and Minerals Sector

- Magnesite

- Lignite

- Iron Ore

The main stock exchange in Austria is:

- 1. Vienna Stock Exchange

- Austria’s principal stock exchange

- Operated by the company Wiener Börse

- Core trading activities are equity and bond markets

- Also separately operates the Energy Exchange Austria and the CEGH Gas Exchange

- Main Index

i. ATX

Glimpse into Austria’s Equity Market

Austrian equities have experienced a strong recovery following the recent recession, with the Market Capitalization of its listed companies increasing by 26% from $53.6 billion in 2009 to $67.7 billion in 2010.

In 2010, the Vienna Stock Exchange had 10 IPOs issued by domestic and foreign enterprises.

| Stock Index Performance: ATX |

| Values: | |||||||||||

|

Last |

-1 Mo. |

-3 Mo. |

-6 Mo. |

-9 Mo. |

-1 Yr. |

-3 Yr. |

-5 Yr. |

-10 Yr. |

|||

|

6/10/2011 |

5/10/2011 |

3/10/2011 |

12/10/2010 |

9/10/2010 |

6/10/2010 |

6/10/2008 |

6/12/2006 |

6/11/2001 |

|||

| Price |

2,707.50 |

2,864.00 |

2,806.83 |

2,829.99 |

2,487.27 |

2,338.71 |

4,166.44 |

3,487.03 |

1,227.00 |

||

| Performance: | |||||||||||

|

YTD |

-1 Mo. |

-3 Mo. |

-6 Mo. |

-9 Mo. |

-1 Yr. |

-3 Yr. |

-5 Yr. |

-10 Yr. |

|||

| Value Change |

-24438.00 |

-156.50 |

-99.33 |

-122.49 |

220.23 |

368.79 |

-1,458.94 |

-779.53 |

1,480.50 |

||

| % Change |

-5.46% |

-3.54% |

-4.33% |

8.85% |

15.77% |

-35.02% |

-22.55% |

118.72% |

|||

Source: Datastream

Austria’s 10 Most Profitable Companies in 2010

| Rank | Company | Sector | Industry | Symbol/Ticker | Profit ($ mil) | Revenue ($ mil) |

|

1 |

Raiffeisen Bank International AG | Banks | Financials | RBI-VI |

1,458.88 |

12,853.72 |

|

2 |

OMV AG | Oil&Gas | Energy | OMV-VI |

1235 |

31,289.03 |

|

3 |

Erste Group Bank AG | Banks | Financials | EBS-VI |

1,172.9 |

15,954.51 |

|

4 |

Voestalpine AG | Metals&Mining | Materials | VOE-VI |

727.57 |

15,544.3 |

|

5 |

Verbund AG | Electric Utilities | Utilities | VER-VI |

537.68 |

4,437.64 |

|

6 |

Wiener Stadtische Versicherung AG | Insurance | Financials | VIG-VI |

509.45 |

12,533.49 |

|

7 |

EVN AG | Electric Utilities | Utilities | EVN-VI |

282.53 |

3,757.19 |

|

8 |

Telekom Austria AG | Diversified Telecommunications | Telecommunication Services | TKA-VI |

262.07 |

6,239.23 |

|

9 |

Andritz AG | Machinery | Industrials | ANDR-VI |

240.92 |

4,767.5 |

|

10 |

Strabag SE | Construction&Engineering | Industrial | STR-VI |

234.58 |

16,610.17 |

Ways to Invest in Austria

There are a couple of different ways to invest in Austrian companies:

- Through established foreign and domestic investment or financial firms with brokerage services

- Through a regional Austrian bank

- Investors can access Austrian equities through Austrian banks

- Bank Austria

- Ostereichische Postsparkasse (P.S.K)

- Raiffeisenbanken

- Austrian ETFs

- EWO: NYSEArce – tracks the MSCI Austria Investable Market Index

- Through some international online brokers:

- MB Trading

- Interactive Brokers

- TD Ameritrade

- E-Trade

- Questrade

- optionsXpress

- optionshouse

- tradeMONSTER

- Charles Schwab

- Investors can access Austrian equities through Austrian banks

Argentina is a South American country that is one of the G20 economies. It is the third largest economy in Latin America and has the highest GDP per capita in its region. It possesses plenty of natural resources, a strong agricultural sector, and a well-educated population.

Argentina’s Main Industries

- Agriculture: beef, fruits and vegetables, wheat, cattle, tabacco

- Natural Resources: shale oil, coal, natural gas, forestry products

- Metals: gold, copper, zinc, magnesium, uranium, silver

- Manufacturing: food processing, chemicals and pharmaceuticals, auto parts, iron and steel, industrial machinery, textiles, cement

Argentina’s Main Stock Exchanges

The two main stock exchanges in Argentina by size are Buenos Aires Stock Exchange (BCBA) and Rosario Stock Exchange (BRVM).

Buenos Aires Stock Exchange

- Argentina’s largest and primary stock exchange

- Operates as a self-regulating, non-profit entity

- MERVAL is the main index

Ways to Invest in Argentina

There are a couple of different ways to invest in Argentine companies:

Argentinian Banks and Financial Firms

- Santander Rio

- BBVA Banco Frances

- BNP Paribas

- BACS BANCO DE CREDITO Y SECURITIZACION

Argentina ETFs

International Online Brokers

Glimpse into Argentina’s Equity Market

Considered an emerging economy, Argentina attracts significant foreign investors and capital.

In 2022 Foreign Direct Investment (FDI) increased in Argentina to $15 billion, (source: World Investment Report 2023). With the 3rd largest economy in Latin America, it has gained a reputation as a country with high inflation and a complex regulations. However, the government has been implementing policies to attract more foreign investment.

There are opportunities in the energy industry as Argentina has significant shale gas and oil reserves. Mining is another big industry with several major producers of copper, lithium and other minerals in the country. Buenes Aires is also emerging as a major tech center for Latin America. With many skilled workers and a lower cost of living compared to other tech hubs, new Argentinian tech startups are experiencing a competitive advantage. The government is aiming to support continued technological innovation through tax incentives in high-tech sectors.

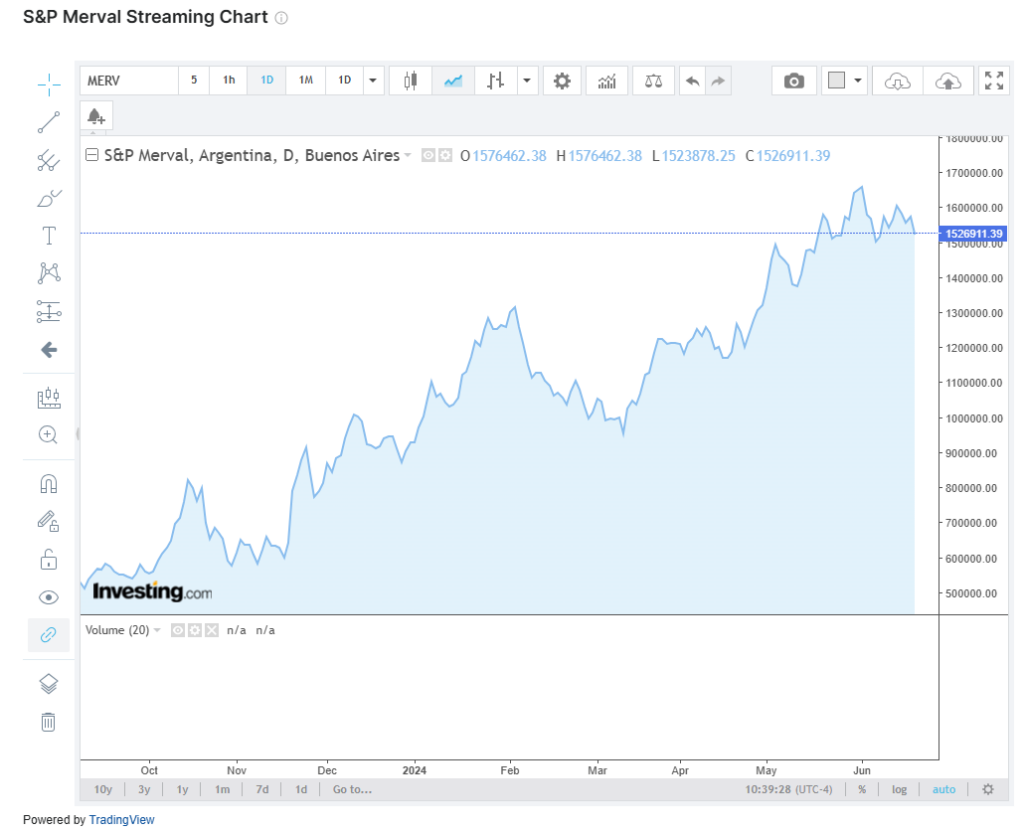

Stock Index Performance: MERVAL

The MERVAL (stock index) is a weight-adjusted fund that has been trading since 1986. It was initiated by the S&P Dow Jones Indices in 2019. MERV reached an all-time high in May 2024. Since the beginning of 2024, the index has increased 69.57%.

Argentina’s Largest Companies by Market Cap (as of 2024)

Consultancy A.T. Kearney does a periodic study of worldwide investments by managers at the world’s largest companies and how the economy effects those investments. In 2007 there was an all-time high investment of $1.98 trillion in 2007 by these multinational companies. Foreign direct investment worldwide fell 14% in 2008. In 2009, it fell another 39%. A.T. Kearney says that these investments have only started to increase recently. The multinationals postponed much of their planned investments due to continued market uncertainty and the problems in obtaining credit.

Recently there has been a rise of emerging markets. As you would expect, the top countries for investment include China, India, and Brazil. Poland has moved up 16 rungs to weigh in at No. 6. Other countries to enter the top 25 include: Romania, Saudi Arabia, Chile, and Egypt. For a more detailed look at the top countries for foreign investment by international executives, please visit these links:

| Albania | Hungary | Peru |

| Argentina | Ireland | Portugal |

| Austria | Italy | Romania |

| Belgium | Latvia | Serbia |

| Chile | Lithuania | Spain |

| Columbia | Luxembourg | Sweden |

| Denmark | Moldova | Switzerland |

| Ecuador | Netherlands | Turkey |

| France | Norway | United Kingdom |

| Greece |

Gross National Product is the value of all goods and services produced by a country’s residents.

GNP

- Is based on the market value of goods and services

- Takes only final goods and services into consideration

- Relies on factors of production such as the country’s labor and capital

- Is measured on an annual basis

How is GNP used?

Gross National Product statistics are used to

- Measure the economic activity of a country

- Evaluate and analyze economic growth

- Assess how productive a country’s factors of production are

- Measure the value of important goods and resources

- Analyze the income earned by a country’s residents

- Compare the performance of different countries

- Develop economic policies aimed at improving GNP figures

How is GNP Measured?

Two approaches can be used to measure GNP: (1) The Income Approach (2) The Expenditure Approach

(1) Income Approach

- Measures the income or earnings received by the country’s factors of production (Labor, Land, Capital)

GNP = Wages + Interest Income + Rental Income + Profit

- GNP or National Income is the sum of

- Wages

- The salaries, income or earnings that residents received for their work and labor during an entire year

- Interest Income

- Any income earned from holding assets or funds in

- Bank savings accounts

- GICs

- Treasury-Bills

- Canada Savings Bonds

- Interest earned on foreign investments

- Any income earned from holding assets or funds in

- Rental Income

- Any income earned from owning and renting property.

- Includes income from renting

- A house

- Apartments

- Rooms

- Office space

- Profit

- Income earned from investments (e.g., dividends from stocks)

- Wages

(2) The Expenditure Approach

- Measures the amount spent or paid (expended) on all goods and services during the year at market value or prices

- Uses and sums up two main components: (1) Gross Domestic Product and (2) Net Income from Abroad

- We need to first calculate Gross Domestic Product (GDP)

- GDP is the value of a country’s products and services produced in year

- 5 main components of GDP

- Private Consumption and Expenditure (households) – C

- Investment Expenditure – I

- Government Expenditures – G

- Exports – X

- Imports – M

- 5 main components of GDP

- GDP is the value of a country’s products and services produced in year

- We need to first calculate Gross Domestic Product (GDP)

GDP = Private Consumption + Investment Expenditure + Government Expenditures + Net Exports

GDP = C + I + G + (X – M)

Next, we determine Net Income from Abroad, which is composed of

-

- Income from Abroad – income received by citizens from overseas business activities

- Income to abroad – income provided to foreign citizens from their business activities in the domestic country

Using both components, we calculate GNP as

GNP = GDP + Net Income from Abroad

Conclusion

The Gross National Product (GNP) is an economic measure of the market value of all goods and services produced by a country’s residents. It is an important and widely followed statistics that indicates the strength and growth of an economy, as well as the productive use of its factors of production such as labor and capital. It can be measured using the income or expenditure approach.

Key Words: Gross, National, Product, GNP, Economic, Activity, Measure, Market, Value, Goods, Products, Services, Residents, Citizens, Country, Factors, Production, Labor, Capital, Resources, Gross, Domestic, Product, Income, Expenditure, Approach, Wages, Interest, Income, Rental, Profit, Private, Consumption, Government, Investment, Net, Exports, Imports, Abroad,

Free Cash flow is the cash available to all the capital providers of a company

There are two types of free cash flows

- Free Cash Flow to the Firm (FCFF)

- Cash flow available to pay out to all capital providers such as common stock holders, debt holders, and preferred stock holders.

- Free Cash Flow to Equity (FCFE)

- Cash flow that is available strictly to the company’s common stock holders (equity)

The FCFF and FCFE are not reported on a company’s financial statements, therefore, the analyst or investor must perform necessary calculations to arrive at these figures.

Financial Statement Items

First, we review some of the necessary financial statement items need to compute FCF

Net Income: the Earnings of the company after operating, interest, depreciation, and tax expenses have been made

Noncash charges: include items such as depreciation which do not represent an actual outflow of cash

Capital Expenditures: the company’s investments in fixed assets and capital. These are an important source of future growth for a company

Working Capital: the company’s short-term capital necessary to conduct its daily business operations. These include:

- Receivables

- Inventory

- Payables

Cash Flow from Operations: The net amount of cash from the company’s operating activities

Interest Expenses: the company’s costs of assuming debt

Liabilities / Borrowing: The amount that the company borrows in terms of its debt obligations

FCFF and FCFE Equations

Free Cash Flow to the Firm (FCFF)

Cash available after operating expenses, working capital, and capital expenditures have been taken into consideration.

The company can use this cash flow to:

- Pay its common equity holders with dividends

- Pay its debt holders back (i.e., pay down its principal)

- Pay its preferred equity holders

Equation:

FCFF = Net Income + Noncash items + Interest Expenses (1-Tax Rate) – Capital Expenditures – Working Capital Requirements

Free Cash Flow to Equity (FCFE)

Cash available to common equity holders after payments related to debt are made and working capital and capital expenditures are taken into account.

The payment s relating to debt include:

- Payments such as interest expenses and debt principal repayment

The company can use this available cash flow to pay its common stock holders.

Equation:

FCFE = Net Income + Noncash items – Capital Expenditures – Working Capital Requirements + Net Borrowing

Why are FCFs used?

Some uses and applications of FCFs

- To assess the company’s ability to pay its equity and debt capital providers

- FCFs can be used when the company does not pay dividends, and as such, does not have a track record of paying equity holders. FCFs can indicate how much the firm can pay out

- FCF can be used by a company to repay the principle related to its long-term debt

- FCFs are used with for firm valuation purposes, such as with Discounted Cash Flow (DCF) models to measure a company’s intrinsic value

Conclusion

Free cash flows are a company’s cash available after operating expenses, capital expenditures and working capital requirements have been accounted for. It represents the funds available for the company’s capital providers. The FCFF represents cash available to both equity and debt capital providers, while the FCFE is the cash flow that can be reserved to the company’s common equity holders. FCFs play an important role in financial modeling and discounted cash flow techniques in determining valuation for an asset or financial security

Key Words: Free, Cash, Flow, Firm, Discounted, DCF, Equity, FCF, FCFF, FCFE, Available, Operating, Capital, Expenditure, Fixed, Assets, Working, Requirements, Common, Equity, Debt, Capital, Holders, Providers, Valuation, Financial, Statements, Net, Income, Noncash, items, Depreciation, Interest, Expense, Tax, Operations, Principal, Debt, Liabilities, Borrowing, Receivables, Payables, Inventory, Cost, Dividends, Intrinsic, Value, Preferred, Security, Dividends, Measure, Assess, Modeling

The Form-8K is a SEC-mandated report filed by public companies to report unexpected events or transactions that are material in nature, and thus have an impact on the share prices of the company.

In accordance with the Securities Exchange Act (1934), specifically defined events must be reported within 4 business days. The main purposes of the Form 8-K are to:

- Satisfy regulatory requirements

- To provide investors and shareholders with up-to-date company information

- Update previously released reports such as the 10-Q (quarterly report) and the 10-K (annual report) with important developments.

The criteria for reporting such material events or transactions are defined within 9 major sections or categories. These events (or transactions) are deemed to be significant for investors and shareholders towards their investment-decision making.

Why are Form 8-K reports important?

To make sound investing decisions, investors need information that is timely, reliable, and accurate. Material information concerning the activities, operations, and business of a corporation can have a significant impact on important aspects such as

- Future revenues, earnings, cash flows, and other financial items

- Strategic direction

- Competitive positioning in the market

- The industry it operates in

Such factors inevitably will impact its share price in the market. Therefore, it is important that investors have access to important information that is crucial in making investment decisions.

Annual reports (10-K) and quarterly reports (10-Q) contain valuable information. However, there is a time lag between the issuance dates of such reports. The Form 8-K is therefore used as a vehicle to report material events not captured by the 10-Q or 10-K.

What are material events?

The actual Form 8-K is available for download on the SEC’s website at:

http://www.sec.gov/about/forms/form8-k.pdf

Material events fall under one of 9 main sections.

Section 1- Registrant’s Business and Operations

MATERIAL EVENTS:

- Entry into a material definitive agreement

- Termination of a material definitive agreement

- Bankruptcy or receivership

Section 2- Financial Information

MATERIAL EVENTS:

- Completion of acquisition or disposition of assets

- Results of operations and financial condition

- Creation of a direct financial obligation or an obligation under an off-balance sheet arrangement of a registrant

- Triggering events that accelerate or increase a direct financial obligation or an obligation under an off-balance sheet arrangement

- Costs associated with exit or disposal activities

- Material impairments

Section 3- Securities and Trading Markets

MATERIAL EVENTS:

- Notice of delisting or failure to satisfy a continued listing rule or standard; Transfer of listing

- Unregistered sales of equity securities

- Material modification to rights of security holders

Section 4- Matters Related to Accountants and Financial Statements

MATERIAL EVENTS:

- Changes in registrant’s Certifying Accountant

- Non-reliance on previously issued financial statements or a related audit report or completed interim review

Section 5- Corporate Governance and Management

MATERIAL EVENTS:

- Changes in control of registrant

- Departure of directors or certain officers; Election of directors; Compensatory arrangements of certain officers

- Amendments to articles of incorporation or bylaws;

- Change in fiscal year

- Temporary suspension of trading under registrant’s Employee Benefit Plans

- Amendments to the registrant’s code of ethics, or waiver of a provision of the code of ethics

- Changes in shell company status

- Submission of matters to a vote of security holders

Section 6- Asset-Backed Securities

MATERIAL EVENTS:

- Change of servicer or trustee

- Change in credit enhancement or other external support

- Failure to make a required distribution

- Securities act updating disclosure

Section 7- Regulation FD

MATERIAL EVENTS:

- Regulation-required disclosures

Section 8- Other events

MATERIAL EVENTS:

- other events deemed material or having important informational value

Section 9- Financial Statements and Exhibits

MATERIAL EVENTS:

- financial statements of businesses acquired

- pro-forma financial information

- shell company transactions

Conclusion

The Form-8K report is crucial for investors and shareholders in remaining current on major or material events and transactions performed by a company.

Such events typically have the ability to affect the firm’s stock price. Therefore, investors use such information to update their investment decisions such as buying, selling, or holding the stock.

The Form 8-K report is mandated by the SEC, with the purpose of providing timely and relevant information not included in annual or quarterly reports.

Key Words: Form 8-K, Report, Securities, Exchange, Commission, Material, Events, Information, Revenues, Earnings, Cash Flows, Financial, Statements, Mergers, Business, Operations, Securities, Trading, Markets, Certified, Accountants, Corporate, Governance, Management, Asset, Backed, Securities, Regulation, Exhibits

Fixed income analysis is the process of evaluating and analyzing fixed income securities for investment purposes.

Fixed Income represents a distinct asset class. Investors and analysts perform fixed-income analysis to

- Evaluate the risk characteristics underlying debt securities and to assess the capacity of the borrowing entity to meet its financial obligations (credit analysis)

- Identify which debt securities represent attractive investment opportunities

- Determine the appropriate valuation (or value) of debt securities in the market

- Compare the investment characteristics (e.g., risk and return) of debt securities with each other and with other asset classes such as stocks, derivatives, real estate, or other.

Features and Characteristics of Fixed Income

Some important features of fixed income securities include

- Government versus Corporate Bonds

- On a very broad level, fixed income securities can be categorized as

- Government

- E.g., US Treasuries

- Government

- Corporate

- Bonds issued by public corporations

- Issuer

- The party, entity, or corporation that sells the debt obligation to investors

- This is the borrowing entity

- Borrower or Debt Security Holder

- The party that has purchased the debt obligation (i.e., the lender)

- Principal or Face Value

- The amount borrowed which has to be repaid in full at a future date

- Interest

- The interest rate that is applied to the principal borrowed amount

- Periodic Payments

- The periodic dates during the life of the debt for which the borrower is responsible for making regular payments of interest or principal (or both)

- Maturity

- The length of time from the inception of the debt to its termination

- Fixed-Income Options

- Options embedded within fixed income securities giving the lender or borrower the right to either redeem the obligation

- Callable Bond – the issuer of the debt obligation retains he right to redeem the bond before its maturity date

- Putable Bond – the holder of the debt obligation (the borrower) retains the right to redeem the bond before its maturity date

- Convertibility

- Convertible debt securities allow the debt security holder to convert the debt obligation into common equity

- Options embedded within fixed income securities giving the lender or borrower the right to either redeem the obligation

- On a very broad level, fixed income securities can be categorized as

Elements of Fixed Income Analysis

The following elements are typically common when analyzing the fixed-income security of a corporation

- Credit Analysis

- Analysis of the company’s financial statements

- Assessment of creditworthiness and capacity to pay

- Analysis of collateral and covenants

- Risk Analysis

- Corporate fixed-income securities are exposed to certain risks, which can include one or more of the following

- Interest rate risk

- Inflation risk

- Credit or default risk

- Liquidity risk

- Foreign Exchange risk

- Sovereign risk

- Fixed-Income Valuation

- A time-value based formula and methodology is used to value fixed income securities

- The bond’s interest payments and principal are discounted back to today, to arrive at a present value figure (which is the bond’s value)

- The present value of each future cash flow is found and summed up

- Corporate fixed-income securities are exposed to certain risks, which can include one or more of the following

- The following are needed to perform the valuation

- The coupon or interest rate

- The coupon or interest payments

- The Face Value or Principal amount

- The discount rate used to find the present value of each future cash flow

- Comparison with Government Debt Securities

- Fixed-income analysis also includes a comparison of the corporate debt-security’s return or yield with that of risk-free US government debts (Treasuries)

- These are highly safe, liquid, and debt obligations

- The return on Treasuries is seen by investors as the minimum acceptable or possible return in the market

- The return on corporate fixed income securities is compared to the return on US treasuries to measure the “extra” yield/return offered (also referred to as risk premium)

- This extra return is required by investors for assuming the risks inherent in corporate fixed income securities (see above for list of risks)

- Fixed-income analysis also includes a comparison of the corporate debt-security’s return or yield with that of risk-free US government debts (Treasuries)

Conclusion

Fixed income analysis is the analytical framework used to evaluate and assess fixed income securities for investment purposes. This includes credit and risk analysis, as well as bond valuation. It applies to securities such as government and corporate bonds, and plays an important role in the trading and pricing of such instruments in the market.

Key Words: Fixed, Income, Analysis, Debt, Securities, Obligations, Analytical, Framework, Evaluate, Assess, Investment, Credit, Risk, Free, Government, Corporate, Bond, Valuation, Financial, Security, Interest, Rate, Principal, Coupon, Maturity, Risk, Issuer, Borrower, Principal, Face, Value, US, Treasuries, Measure, Determine, Pricing, Market, Value, Options, Callable, Putable, Convertible, Financial, Statements, Creditworthiness, Capacity, Collateral, Covenants, Inflation, Liquidity, Sovereign, Foreign, Exchange, Default, Time, Present, Value, Yield,

In investment valuation, financial modeling refers to the procedure and methodology performed to determine the value of an asset or financial security

Fundamentally, a business or company’s current value can be viewed as being derived from its future cash flow streams. An investor deciding whether to purchase or sell a stock, therefore, will be interested in estimating such value.

Financial modeling is the creation of a program or structure designed to incorporate a company’s financial information and projections, and subsequently come up with a valuation used for investment decision making.

Uses and Applications

Financial modeling has multiple uses and applications

- Portfolio Management and Security Valuation

- Analysts and portfolio managers use financial modeling to determine a stock’s fair or intrinsic value

- Used as a basis for making investment decisions and recommendations such as buying, selling, or holding financial securities

- Investment Banking and Private Equity

- Investment bankers use financial modeling to develop valuation figures for merger and acquisition candidates

- Private equity investors make extensive use of financial modeling when making investment decisions regarding leverage buyouts and management buyouts

- Real Estate Investment

- Financial modeling is used by real estate developers and investors in determining the fair value of properties

- Corporate Finance

- Executive management use financial modeling for capital budgeting decisions such as

- Investing in new projects, fixed assets, or equipment

- Determining the value-creation or destruction from replacing existing assets or equipment

- Executive management use financial modeling for capital budgeting decisions such as

Key Elements in Financial Modeling

The use of advanced computer software is typically used to conduct DCF. Microsoft Excel is commonly used for its spreadsheet capabilities.

Assume that an analyst would like to use financial modeling to determine the value of a corporation. It can be performed as follows

- Historical financial statements are used as a starting point

- The company’s historical financial results are tabulated. The following statements are used

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Analysts typically use 2-5 years of historical results

- The company’s historical financial results are tabulated. The following statements are used

- Financial projections, financial forecasts, and financial estimates are made

- The analyst will use assessment of the economy, industry, and market to make key assumptions regarding future conditions. This forms the basis of determining future projections.

- Growth rate estimates or projected values for the company’s key financial statement elements are made, such as for

- Revenues, expenses, depreciation, interest expenses, and net income

- Assets

- Liabilities

- Capital expenditure

- Debt projections

- Development of Pro-forma financial statements

- Using the forecasts developed above, the complete set of projected financial statements are developed

- Projection of Cash Flows

- Cash flows can be defined in several ways

- Using the pro-forma statements, the analyst will usually determine the company’s free cash flows

- Free Cash flows are the company’s available cash after accounting for capital expenditures and working capital requirements

- Such FCFs form the basis of discounted cash flow valuation.

- Determination of the Discount Rate

- To value the projected cash flows, a discount rate is estimated.

- This rate will be used to find the present value of each projected cash flow

- DCF Analysis

- The value obtained using DCF will be analyzed to determine whether it is appropriate

- Usually, DCF is complemented with sensitivity analysis, which takes into consideration various scenarios regarding growth estimates and discount rates,

- Investment decision is made

Conclusion

Financial modeling is a valuation methodology or program aimed at determining an asset or financial security’s value for investment decision-making purposes. It encompasses inputs from a company’s historical financial statements, development of assumptions and projections regarding its financial information, and using discounted cash flow techniques or models to produce a valuation figure. It is extensively used in portfolio management, security analysis, investment banking, and corporate finance.

Key Words: Valuation, Value, Asset, Financial, Security, Statements, Future, Discounted, Free, Cash, Flow, DCF, Stock, Security, Analyze, Determine, Portfolio, Management, Investment, Banking, Corporate, Finance, Private, Equity, Investor, Decision, Making, Analyst, Recommendation, Buy, Sell, Hold, Mergers, Acquisitions, Leveraged, Buyout, Historical, Discount, Rate, Discounting, Projected, Growth, Rate, Pro-forma, Development, Assumptions,

The diligent investor knows that he or she needs relevant, timely, and high-quality information in order to make sound investment decisions.

The earnings reports released by companies can be invaluable in providing such information. Released by public companies on a quarterly and annual basis, they can be used to assess and gauge a company’s:

o financial condition

o strategic plans

o industry and competitive position,

o Key performance drivers and risk factors

o Future performance

SEC REGULATIONS

Publicly-traded companies are required to file earnings reports with the Securities and Exchange Commission on a quarterly (10-Q) and annual basis (10-K). Such reports have to be furnished within a specified timeline after the ending of the company’s accounting cycle.

ELEMENTS OF EARNINGS REPORTS

HIGHLIGHTS

The first section of these reports typically provides an overall summary of the company’s financial performance and key developments. A comparison between current results and prior years’ or quarters’ numbers are used to indicate how the company fared during the period. Brief highlights include:

o Financial results such as sales, expenses, net income, EPS (along with growth percentages from prior periods)

o Performance of key business segments or product lines

o Important industry developments

STRATEGIC AND INDUSTRY ANALYSIS

Within earnings reports, companies will usually provide detailed information regarding the strategic plans of executive management.

Investments in new markets, business segments, or products can indicate the strategic direction the company is heading towards.

Key drivers affecting the execution and performance of such strategies are usually elaborated on.

An analysis of important industry and market developments and their impacts is also commonly presented.

KEY RISK FACTORS

Since the future performance of the company is uncertain, and is dependent on a multitude of unpredictable forces, management usually pinpoints important factors that might have negative impacts to the business.

Such factors can be country, industry, or company-specific or a combination.

Examples include:

- Political events

- Technological developments

- Demographic trends

- Inflation

- Interest rates

- Business cycles and stock market fluctuations

- Volatility of prices

MANAGEMENT AND DISCUSSION ANALYSIS (MD&A)

In the MD&A section, executive management (commonly the CEO or CFO) present an in-depth analysis of the financial, operational, and business performance of the company.

An examination of trends and comparison with prior-period results is discussed, with the aim of explaining such fluctuations.

Detailed analysis is provided regarding items such as business segments & product lines, capital investments, production & operations, industry and market developments, mergers/acquisitions, and many other company specific items of interest.

FINANCIAL STATEMENTS AND SUPPLMENTAL SCHEDULES

Prepared in accordance with accounting principles (e.g. US/Canadian GAAP, International GAAP), the company’s financial statements are presented. Additionally, the historical statements are shown alongside current-period numbers for comparison purposes.

Main Financial Statements:

o Income Statement

o Balance Sheet

o Statement of Cash Flows

o Statement of Comprehensive Income

o Statement of Retained Earnings

Supplemental Schedules can include information regarding:

o Operations and production

o Capital expenditure

o Business-segment specific data

o Debt or Long-term liabilities schedules

o Employee stock options

o Other company-specific info

ACCOUNTING PRINCIPLES & RULES

Companies can use a multitude of accounting principles and rules to recognize, present, and report financial results to investors.

Within earnings reports, investors will typically find a section detailing the assumed accounting principles used by the company regarding such items as:

o Revenue recognition

o Expense recognition (the capitalization of expenditures versus expensing them)

o Inventory valuation rules (e.g. FIFO, LIFO)

o Depreciation (e.g. straight-line, declining-balance, etc)

o Investments in other companies and accounting for mergers and acquisitions

o Foreign exchange translations

o Pension accounting

o Off-Balance Sheet items (e.g. leases, SPV)

USING EARNINGS REPORTS TO ASSESS EARNINGS QUALITY

Company management has, at their disposal, numerous accounting principles and rules that they can be used to recognize financial information and report their results to the public, and this presents investors with several challenges.

Recognizing that financial information has a significant impact on the company’s stock price performance (and thus executive compensation) management has strong incentives to choose accounting principles that will allow them to portray the company’s financial position in the best light possible.

A well-informed and diligent investor will scrutinize the company’s assumed accounting principles to assess the impact of the choice of such rules on the reported results. This in turn, will allow the investor to gauge the quality of the earnings (i.e. how reflective they really are of actual performance and financial condition), and adjust their analysis accordingly.

Some accounting principles can be used to:

o Recognize revenue too early

o Excessively capitalize expenses (which defers their negative impact on earnings)

o Report certain gains and losses in comprehensive income, thus bypassing the income statement

o Mask liabilities by overly using off-balance-sheet accounting

o using investment accounting principles to reduce volatility of reported investment results

CONCLUSION

The financial and non-financial information within earnings reports can be used to make sound investment decisions.

They can be an excellent tool in evaluating and valuing the financial health, strategic and industry position, and the future performance of the company.

As such, the well-informed investor will scrutinize all information, including the impact of accounting principles on reported results – which can affect the quality of reported earnings.

Discounted Cash Flow is a valuation technique or model that discounts the future cash flows of a business, entity, or asset for the purposes of determining its value.

One aspect of investment decision-making entails discovering the fair value of investments. The DCF rests on the principle that an asset’s fair value is the present value of all its future cash flows. Investors seek such value to

- Determine a fair valuation for assets such as financial securities, business entities or divisions, or any asset that produces future cash flows

- Compare an asset’s estimated DCF value with its market price today

- Decide whether to purchase an asset or dispose of an investment holding

- Compare the values of various assets or financial securities

Uses and Roles of DCF

DCF is used in areas such as

- Portfolio Management

- Financial analysts use DCF to find the fair or fundamental value of financial securities such as stocks and bonds

- Using DCF estimates, analysts make stock buy or sell recommendations to their clients

- Portfolio managers use DCF results to decide on which financial securities to add or remove from their portfolios

- Typically, DCF analysis results in comparison between an asset’s DCF value and its market price

- If DCF value > market price = asset is undervalued

- If DCF value < market price = asset is overvalued

- If DCF = market price, asset is fairly valued

- Investment Banking and Private Equity

- Investment bankers use DCF to determine appropriate values for transactions in

- Mergers and Acquisitions

- Leverage Buyouts

- Management Buyouts

- Investment bankers use DCF to determine appropriate values for transactions in

- Corporate Finance and Management

- In corporate finance, DCF is used in capital budgeting to assess the profitability of company-specific projects such as

- Investing in new fixed assets or equipment

- Replacing existing assets or equipment

- Investing in new business divisions or subsidiaries

- In corporate finance, DCF is used in capital budgeting to assess the profitability of company-specific projects such as

How is DCF performed?

DCF uses a time-value based formula to determine the value today, of a single or set of future cash flows. The main steps in performing DCF can be summarized as follows

- Define a time period or horizon

- DCF models require a time period for which the future cash flows will be projected

- Time horizons are typically chosen between 1-10 years

- However, the longer the period chosen, the more uncertainty there will be regarding forecast figures

- Determine the discount rate

- This is the rate used to find the present value of all future cash flows

- Depending on the asset being valued, the discount rate can be

- The cost of equity

- The cost to the firm of its equity capital. This is basically the return demanded by its equity or stock holders

- Used when valuing a firm’s equity or stock

- The weighted average cost of capital (WACC) – also referred to as the cost of capital

- Used to find the value of the entire company or firm

- Takes into consideration the cost of all sources of capital providers: common equity holders, preferred equity holders, and debt holders

- The cost of equity

- Define the asset or financial security’s cash flows. For example, they can be defined as

- Dividends

- Free cash flows

- Find the asset’s current cash flows or earnings

- This is found by looking at current financial statements and determining the company’s current or historical dividends or free cash flows

- Develop expected or projected growth rates

- Growth rates will be used to forecast expected future cash flows within a specified time horizon

- With multiple and indefinite future cash flows, determine a perpetual or stable growth rate

- Usually when valuing company cash flows, an assumption must be made regarding when a company’s cash flows will “stabilize” and grow consistently at the same rate into the future

- Using the projected growth rates, determine the future cash flows within the time period specified

- Using the discount rate above, find the present value of each future cash flow component

Advantages and Disadvantages

Advantages of DCF

- Is a fundamentally sound valuation technique that can be used to determine fair or intrinsic value

- DCF can be used to assess the market’s gauge of a particular investment’s value.

- DCF is particularly useful with companies that generate stable cash flows

- Can be used with companies that have negative earnings

Disadvantages of DCF

- It can be very hard to make accurate projections

- DCF Values are also highly sensitive to its assumptions and estimates. Even minor changes in estimates can cause large swings in value, which causes uncertainty to be large

- DCF is geared for long-term investing horizons, and might not suitable for short-term investors.

- In some cases, a long time horizon is needed, which makes the assumptions even more uncertain

Conclusion

The Discounted Cash Flow model or technique is a method used to determine an asset’s fair or intrinsic value. Its premise rests on the principle that an asset’s fundamental value is the sum of the present values of its expected future cash flows. The present value of such cash flows is found by discounting their future values using a discount rate. DCF is an important valuation tool extensively used in portfolio management, investment banking, and corporate finance

Key Words: Discounted, Cash Flow, DCF, Model, Technique, Valuation, Method, Fundamental, Intrinsic, Value, Investment, Asset, Financial, Securities, Statements, Decision, Making, Future, Cash, Flow, Portfolio, Management, Analyst, Market, Price, Undervalued, Overvalued, Banking, Private, Equity, Corporate, Finance, Time, Period, Horizon, Discount, Rate, Discounting, Cost, Equity, Debt, Weighted, Average, Capital, Firm, Dividends, Expected, Projected, Assumptions, Growth, Earnings, Indefinite, Perpetual,

The Debt-Snowball Method is a debt-management strategy aimed at reducing a borrower’s obligations

Borrowers can use this method to slowly eliminate their debt by focusing on their smallest debt balance, followed by larger ones until all obligations are paid off.

Doing so can:

- Substantially reduce debt in the long-term

- Improve credit ratings by making small minimum payments over a long period of time

- Be used to create good payment habits

Debt Snowball Steps

The Debt-Snowball method can be done using the following steps

- Compile a list of all debt obligations incurred to date

- List the debts from the smallest owed to the largest owed

- The order arrangement of debts depends on the amount (or size) of the debt owed, rather than the actual interest rate

- For each of the debts listed, the best efforts must be made to meet the minimum required payment, regardless of size

- Make an effort to set aside or save extra funds each month

- These extra funds that must be set aside after making the minimum required payments on all the debts above

- Direct the extra funds saved towards paying off the smallest debt owed

- Make consistent extra payments, until all the debt is eliminated

- These are payments in addition to the minimum required amounts

- After eliminating the least owed debt, use the same strategy to eliminate the next smallest debt

- Use the funds directed towards the minimum required payment of the previous debt, plus any extra funds saved, towards payments on the next smallest debt

- Continue this debt-reduction strategy until eventually all debt is eventually paid off

Rationale

Having a significant amount of debt can be over-whelming and stressful. Having a debt-reduction strategy can help an individual use an effective plan and method to tackle one debt problem at a time.

Some rationales for using the debt-snowball method include

- A simple way of reducing a lot of debt

- By making consistent small payments towards debt, the borrower will feel psychologically motivated to stick with his or her debt-reduction strategy as they see their debt load reduced

- Using this method, all borrowers debts are reduced at a certain portion every period

Disadvantages

Disadvantages include

- The method does not address the loans with the highest interest rate attributed to them. These are the debts that are the costliest since they incur a heavy interest charge.

- Requires that all minimum payments on all debt be made. Therefore, this strategy may not be suitable for low-income earners

- The length of time required to eventually pay off all debt can be significant

Conclusion

The Debt-Snowball method is a debt management and reduction strategy used to help borrowers reduce and eventually eliminating their debt burdens. Its principle rests on paying down one’s debt from the least amount owed to the greatest. While making the minimum required payments on all borrowed amounts, surplus or saved funds are directed towards paying off each debt amount until everything is eventually repaid.

Key Words: Debt, Snowball, Method, Management, Reduction, Elimination, Strategy, Obligation, Loan, Borrow, Borrowers, Owe, Least, Greatest, Amount, Size, Largest, Smallest, Balance, Order, Credit, Rating, Payment, Habit, Psychological, Motivation, Minimum, Payment, Interest, Rate, Cost, Expense, Extra, Surplus, Saved, Funds, Money, Income,

| 1 – 100 101 – 200 201 – 300 301 – 400 401 – 500 |

|

Revenue

|

Profit

|

Profit

|

|||

| Rank | Company | Symbol |

($ millions)

|

($ millions)

|

Margin

|

| 401 | WellCare Health Plans | WCG |

6,106.90

|

264.2

|

4%

|

| 402 | CF Industries Holdings | CF |

6,097.90

|

1,539.20

|

25%

|

| 403 | UGI Coporation | UGI |

6,091.30

|

232.9

|

3%

|

| 404 | Hershey | HSY |

6,080.80

|

629

|

10%

|

| 405 | Group 1 Automotive | GPI |

6,079.80

|

82.4

|

1%

|

| 406 | MeadWestvaco | MWV |

6,079.00

|

246

|

4%

|

| 407 | Ryder System | R |

6,050.50

|

169.8

|

2%

|

| 408 | Eastman Kodak | EKDKQ |

6,022.00

|

-764

|

-12%

|

| 409 | NiSource | NI |

6,019.10

|

299.1

|

4%

|

| 410 | Rockwell Automation | ROK |

6,000.40

|

697.8

|

11%

|

| 411 | Mutual of Omaha Insurance | PRIVATE |

5,974.10

|

130

|

2%

|

| 412 | Shaw Group | SHAW |

5,937.70

|

-175

|

-2%

|

| 413 | Harris Corporation | HRS |

5,924.60

|

588

|

9%

|

| 414 | Newell Rubbermaid | NWL |

5,923.40

|

125.2

|

2%

|

| 415 | Pepco Holdings | POM |

5,920.00

|

257

|

4%

|

| 416 | CBRE Group | CBG |

5,912.10

|

239.2

|

4%

|

| 417 | Dr Pepper Snapple Group | DPS |

5,903.00

|

606

|

10%

|

| 418 | Avis Budget Group | CAR |

5,900.00

|

-29

|

0%

|

| 419 | PVH Corp | PVH |

5,890.60

|

317.9

|

5%

|

| 420 | Pacific Life | PRIVATE |

5,879.00

|

679

|

11%

|

| 421 | General Cable | BGC |

5,866.70

|

84.1

|

1%

|

| 422 | Exelis | XLS |

5,839.00

|

326

|

5%

|

| 423 | Health Management Associates | HMA |

5,822.10

|

178.7

|

3%

|

| 424 | O’Reilly Automotive | ORLY |

5,788.80

|

507.7

|

8%

|

| 425 | Fidelity National Information Services | FIS |

5,757.40

|

469.6

|

8%

|

| 426 | SLM Corporation | SLM |

5,756.00

|

633

|

10%

|

| 427 | Seaboard | SEB |

5,746.90

|

345.8

|

6%

|

| 428 | Emcor Group | EME |

5,731.70

|

130.8

|

2%

|

| 429 | Auto-Owners Insurance | PRIVATE |

5,709.50

|

69.1

|

1%

|

| 430 | SanDisk Corp. | SNDK |

5,662.10

|

987

|

17%

|

| 431 | Ralph Lauren | RL |

5,660.30

|

567.6

|

10%

|

| 432 | Mohawk Industries | MHK |

5,642.30

|

173.9

|

3%

|

| 433 | Sealed Air | SEE |

5,640.90

|

149.1

|

2%

|

| 434 | Starwood Hotels & Resorts | HOT |

5,624.00

|

489

|

8%

|

| 435 | Foot Locker | FL |

5,623.00

|

278

|

4%

|

| 436 | Domtar | UFS |

5,612.00

|

365

|

6%

|

| 437 | St. Jude Medical | STJ |

5,611.70

|

825.8

|

14%

|

| 438 | Spectra Energy | SE |

5,602.00

|

1,184.00

|

21%

|

| 439 | Booz Allen Hamilton Holding | BAH |

5,591.30

|

84.7

|

1%

|

| 440 | CH2M Hill | PRIVATE |

5,555.20

|

113.3

|

2%

|

| 441 | Kelly Services | KELYA |

5,551.00

|

63.7

|

1%

|

| 442 | Avaya | PRIVATE |

5,547.00

|

-863

|

-15%

|

| 443 | Laboratory Corp. of America | LH |

5,542.30

|

519.7

|

9%

|

| 444 | Kindred Healthcare | KND |

5,523.30

|

-53.5

|

0%

|

| 445 | Western Union | WU |

5,491.40

|

1,165.40

|

21%

|

| 446 | SPX Corporation | SPW |

5,461.90

|

180.6

|

3%

|

| 447 | NCR | NCR |

5,443.00

|

53

|

0%

|

| 448 | Allergan | AGN |

5,419.10

|

934.5

|

17%

|

| 449 | Rock-Tenn | RKT |

5,399.60

|

141.1

|

2%

|

| 450 | Live Nation Entertainment | LYV |

5,384.00

|

-83

|

-1%

|

| 451 | Graybar Electric | PRIVATE |

5,374.80

|

81.4

|

1%

|

| 452 | Momentive Specialty Chemicals |

5,352.00

|

118

|

2%

|

|

| 453 | Centene | CNC |

5,340.60

|

111.2

|

2%

|

| 454 | Owens Corning | OC |

5,335.00

|

276

|

5%

|

| 455 | Catalyst Health Solutions/Catamarn | CTRX |

5,329.60

|

67

|

1%

|

| 456 | Clorox | CLX |

5,326.00

|

557

|

10%

|

| 457 | Bemis | BMS |

5,322.70

|

184.1

|

3%

|

| 458 | Harley-Davidson | HOG |

5,311.70

|

599.1

|

11%

|

| 459 | Con-way | CNW |

5,290.00

|

88.4

|

1%

|

| 460 | Insight Enterprises | NSIT |

5,287.20

|

100.2

|

1%

|

| 461 | Pitney Bowes | PBI |

5,278.00

|

617.5

|

11%

|

| 462 | Wynn Resorts | WYNN |

5,269.80

|

613.4

|

11%

|

| 463 | BrightPoint |

5,244.40

|

48.8

|

0%

|

|

| 464 | Frontier Communications | FTR |

5,243.00

|

149.6

|

2%

|

| 465 | Gannett | GCI |

5,240.00

|

458.7

|

8%

|

| 466 | Dick’s Sporting Goods | DKS |

5,211.80

|

263.9

|

5%

|

| 467 | Big Lots | BIG |

5,202.30

|

207.1

|

3%

|

| 468 | Allegheny Technologies | ATI |

5,183.00

|

214.3

|

4%

|

| 469 | Telephone & Data Systems | TDS |

5,180.50

|

200.6

|

3%

|

| 470 | Timken | TKR |

5,170.20

|

454.3

|

8%

|

| 471 | W.R. Berkley | WRB |

5,156.00

|

394.8

|

7%

|

| 472 | Fidelity National Financial | FNF |

5,153.70

|

369.5

|

7%

|

| 473 | Casey’s General Stores | CASY |

5,140.20

|

94.6

|

1%

|

| 474 | NetApp | NTAP |

5,122.60

|

673.1

|

13%

|

| 475 | FMC Technologies | FTI |

5,099.00

|

399.8

|

7%

|

| 476 | Biogen Idec | BIIB |

5,048.60

|

1,234.40

|

24%

|

| 477 | CVR Energy | CVI |

5,029.10

|

345.8

|

6%

|

| 478 | United Stationers | USTR |

5,005.50

|

109

|

2%

|

| 479 | Host Hotels & Resorts | HST |

5,003.00

|

-15

|

0%

|

| 480 | SunGard Data Systems | PRIVATE |

4,991.00

|

-149

|

-2%

|

| 481 | Meritor | MTOR |

4,990.00

|

63

|

1%

|

| 482 | Western & Southern Financial Group | PRIVATE |

4,986.40

|

450.4

|

9%

|

| 483 | Yahoo | YHOO |

4,984.20

|

1,048.80

|

21%

|

| 484 | Vanguard Health Systems | VHS |

4,895.90

|

-10.9

|

0%

|

| 485 | Charles Schwab | SCHW |

4,884.00

|

864

|

17%

|

| 486 | Susser Holdings | SUSS |

4,873.80

|

47.5

|

0%

|

| 487 | YRC Worldwide | YRCW |

4,868.80

|

-351.3

|

-7%

|

| 488 | El Paso | EE |

4,860.00

|

141

|

2%

|

| 489 | CIT Group | CIT |

4,855.30

|

26.7

|

0%

|

| 490 | MetroPCS Communications | PCS |

4,847.40

|

301.3

|

6%

|

| 491 | Alliant Techsystems | ATK |

4,842.30

|

313.2

|

6%

|

| 492 | Celgene | CELG |

4,842.10

|

1,318.20

|

27%

|

| 493 | MRC Global | MRC |

4,832.40

|

29

|

0%

|

| 494 | Aleris |

4,826.40

|

161.6

|

3%

|

|

| 495 | J.M. Smucker | SJM |

4,825.70

|

479.5

|

9%

|

| 496 | Rockwell Collins | COL |

4,825.00

|

634

|

13%

|

| 497 | Erie Insurance Group | ERIE |

4,824.00

|

169

|

3%

|

| 498 | Nash-Finch | NAFC |

4,807.20

|

35.8

|

0%

|

| 499 | KeyCorp | KEY |

4,780.00

|

920

|

19%

|

| 500 | Molina Healthcare | MOH |

4,769.90

|

20.8

|

0%

|

| 1 – 100 101 – 200 201 – 300 301 – 400 401 – 500 |