When it comes to investing, if you want to achieve long-term success you need to diversify your portfolio. Portfolio diversification is the process of spreading your investments across different asset classes, such as stocks, bonds, or real estate, as well as across different sectors or market capitalizations, to reduce risk and increase potential returns. When you diversify your portfolio, you create a more stable and resilient investing strategy that can handle market fluctuations, business or economic cycle changes, or other potential risks.

So, how do I diversify a portfolio?

This is a question every investor needs to ask themselves. With so many options available, it can be overwhelming to know where to start. Should you invest in index funds or individual stocks? Should you allocate a larger portion of your portfolio to real estate or digital assets? And how do you balance your investments to suit your individual risk tolerance and time horizon?

By taking a step-by-step approach to building a diversified portfolio, you can reduce your exposure to market volatility, and increase your chances of achieving your financial goals.

In this article, we’ll explain how to diversify your portfolio, including the benefits of diversification, how to identify the right asset classes for your portfolio, and advanced strategies for taking your portfolio to the next level. Whether you’re a seasoned investor or just starting out, this article will provide you with the framework you need to create a diversified portfolio that’s tailored to your needs and goals.

The Benefits of Diversification

There are a few major benefits of diversification. Investors diversify their investments because it helps to reduce risk, and either increases or stabilizes their returns. It also improves the long-term performance of their portfolio.

People invest in the stock market because they want to make more money than they could make by leaving it in the bank. Investors especially do not want to lose money. Capital Preservation is the idea that you want to preserve the money you have invested. Investors never want to be in a position where it would have been better to not have invested at all. So, to make sure that investors are protected from price swings, and to help simplify managing their portfolio, investors try to maintain a fully diversified portfolio.

Reduced Risk

One of the most significant advantages of diversification is its ability to reduce risk. When you invest in a single asset class, such as stocks or bonds, you’re exposed to the potential for significant losses if the market declines. If one asset class experiences a decline, the others can help offset the loss, reducing the overall risk of your portfolio. The same is true if you invest in multiple companies in the same sector or across different industries. It’s very unlikely that all companies in all sectors or industries will be equally impacted by changes in the financial markets.

Increased Potential Returns

Diversification can also help you achieve higher potential returns. This can help you achieve a higher overall return on your investments, as the returns from each investment can complement each other. In other words, the more stocks you own the more likely you are to own a stock that ends up doubling or tripling in price. For example, if you own an equal dollar amount of 10 different stocks and 9 of them stayed at the same price and one of them doubled, your portfolio would be up 10%.

However, a portfolio that consisted solely of stocks may experience significant growth over the long term, but it may also be subject to significant volatility. By adding bonds or other fixed-income investments to your portfolio, you can reduce the overall volatility and increase the potential for steady returns.

When you diversify your portfolio, you make sure that you never have “too many eggs in one basket.” If one of the stocks you have invested in starts to go down in price, you have limited your exposure to that stock by only having a smaller percentage of all your assets in that stock. For beginners, this can mean having no more than 20% of your portfolio in any one stock, ETF, or mutual fund. With real money, as you invest more money into your portfolio and as your portfolio grows in value, you should keep buying different stocks so that eventually you have less than 10% of your money in any one stock.

Diversification means that, for example, if you are investing in stocks in the Banking, Energy, Healthcare, Manufacturing, Luxury and IT industries, you would try to spread your money as evenly as possible across these industries. This way, if the Energy sector as a whole starts to have problems (for example, if the price of oil falls quickly), you don’t have to worry about your entire portfolio, and you have limited the losses you are exposed to from a single market shock.

Types of Diversification

There are 2 main types of diversification to think about as you first start investing.

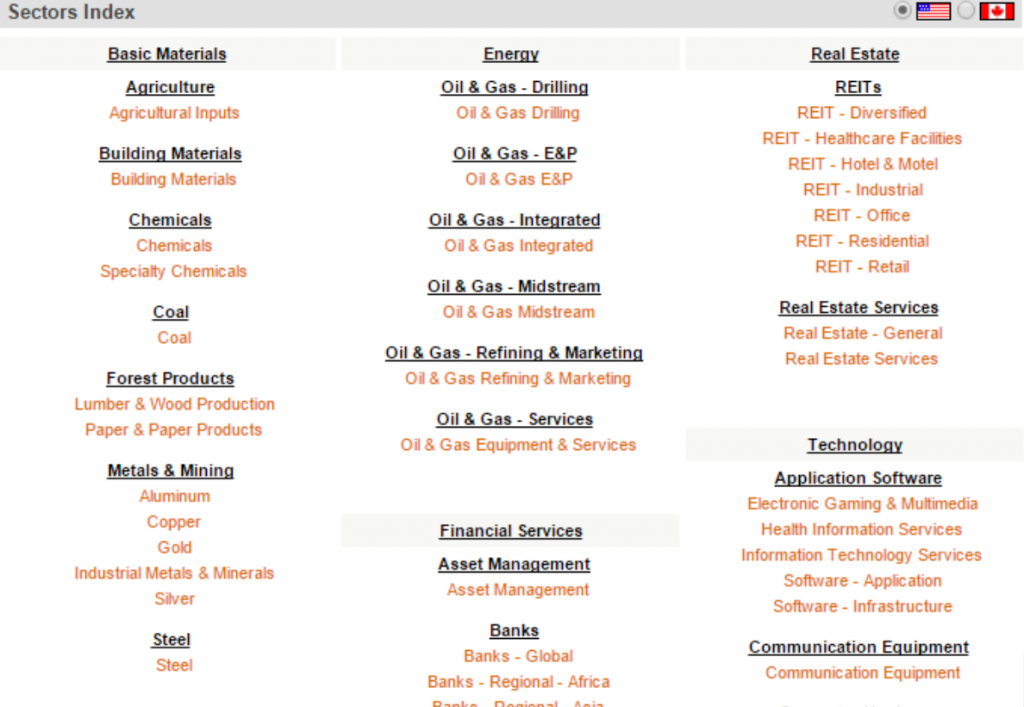

1. Sector Diversification

With sector diversification you invest in different sectors of the economy, such as technology, energy, or manufacturing, to reduce the risk associated with a single sector. To diversify by sector means that you would split your investments across companies based on the type of business they do; energy companies would be oil producers, electricity companies, and companies that specialize in transporting materials needed for energy production. Manufacturing companies are firms that build everything from toys to cars to equipment to airplanes.

The idea behind sector diversification is if some larger trend negatively affects an entire industry, you want to protect the rest of your investments from being affected. For example, low oil prices caused a general decline in energy stocks (of course, with some companies still growing, and others hit especially hard). If you were holding shares in banking companies, these investments would not have been directly affected by this change.

If you’re looking for a good way to find stocks in different sectors, Click Here to see how to research stocks by sector.

2. Stock Diversification

This is the basis of a well diversified portfolio, where you spread your money across several companies, instead of investing all your money in one stock or company. For example, if you want to put 10% of your money in the banking sector, that doesn’t mean you should put 10% of your money in Bank of America. You should have a few bank stocks in case one of your bank stocks is poorly managed and goes bankrupt. Individual stocks are more volatile than sectors, and sectors are more volatile than entire security types, so this is the core of all diversification.

Other Types of Diversification

Geographic Diversification: where you invest in multiple countries or regions, exposing yourself to new risks like political instability, or currency exchange risk. However, you also can benefit from the higher potential growth in emerging markets or developing countries.

Size Diversification: is based on the size of the company, so you would invest in large-cap and small-cap companies to manage the risks of high-growth startups, versus the slower and more steady returns of larger established companies.

Time Diversification: involves separating your investments across different time horizons, so you have some short-term focused assets and some long-term securities so you can have positive future results as well as short-term gains.

Identifying Asset Classes

Each asset class has its own unique characteristics, risks, and potential returns, and by understanding these differences, you can make informed decisions about where to allocate your investments. Each asset class behaves differently in different market conditions. For example, during times of…

- Economic growth: stocks tend to perform well, while bonds may experience lower returns.

- Economic uncertainty: bonds may perform better, while stocks may decline in value.

- Inflation: commodities such as gold or oil may appreciate, while bonds may decline in value.

We cover asset classes in more depth in the article, Basic Investing Strategies, however here is a short explanation for some of the main asset classes.

Stocks

When you invest in stocks you buy shares, or a percentage of ownership, in a company. Stocks have shown to be a great way to grow your wealth over the long-term, as you can earn money from capital gains or dividends. However, the stock market is also very volatile, so prices will fluctuate in the short-term and are considered a higher-risk investment.

Check out this Intro to Stocks article to understand the history and different types of stock. If you need some help picking stocks, check out this article on How to Pick Stocks.

Bonds

When you invest in bonds you are buying a debt security, like an “I owe you” where you lend money to either a company (corporate bonds) or the government (treasury bills or T-notes). The borrower agrees to pay you back at a specific time in the future with interest.

Bonds are considered lower-risk than stocks since they have a fixed rate of return. However, the value of a bond is heavily affected by changes in interest rates. In recent years, the bond markets are experiencing a lot of volatility thanks to high inflation and rapid changes in interest rates.

Check out this Forbes article, The Bond Market Crash – And What One Can Do About It Now to learn more.

Real Estate

Any physical property, be it residential homes, commercial properties or agricultural land would be considered a real estate investment. You can earn money from the appreciation in value or from rental income. Investing in real estate is a great way to diversify your portfolio, however it’s more difficult to get access to your money or turn it into cash. Since it is less liquid than other assets, this type of investment is better suited to longer-term investing strategies.

Commodities

Commodities are physical goods or natural resources that are produced or extracted for sale. Commodities are often traded on markets, such as the futures market or the spot market. Some examples of commodities include:

- Agricultural products (e.g. wheat, corn, soybeans)

- Metals (e.g. gold, silver, copper)

- Energy products (e.g. oil, natural gas, coal)

- Precious stones (e.g. diamonds, rubies, emeralds)

- Livestock (e.g. cattle, pigs, chickens)

There are a few ways you can invest in commodities; directly purchasing the physical goods, (e.g. gold coins), buying and selling futures contracts or options contracts or through Exchange-Traded funds (ETFs) that track the price of a commodity or a basket of commodities.

Commodity prices are notoriously volatile as prices fluctuate rapidly and unpredictably based on supply and demand.

Exchange-Traded-Funds (ETFs) & Mutual Funds

Exchange Traded Funds (ETFs) and Mutual Funds are good places to start investing because these securities are diversified themselves. ETFs and mutual funds take money from investors and invest that money in a variety of securities that meet the stated objective of that fund. The key difference between the two is that mutual funds are actively managed, so you will pay higher fees than with ETFs.

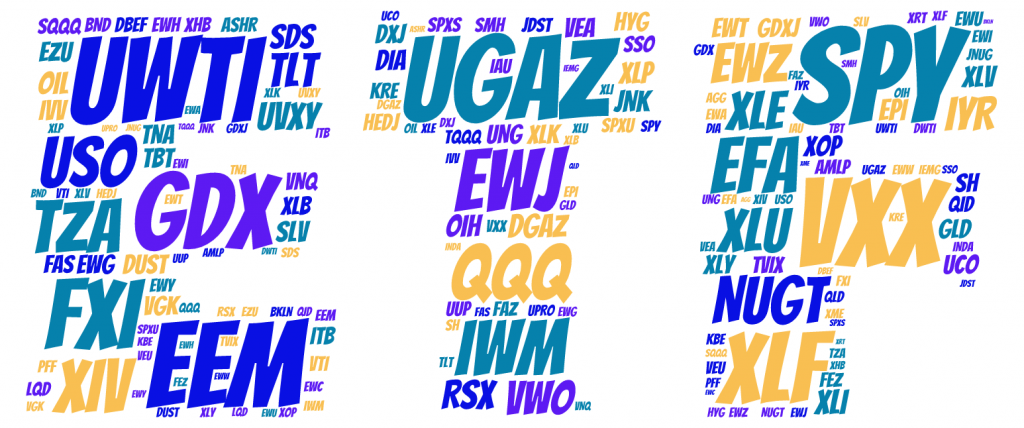

Some funds invest in large companies, some in European companies, some in utilities, some in commodities like gold and oil, etc. For example the ETF FHLC is a collection of Health Care stocks. If you are looking for an easy way to invest in a particular industry, without having to research which particular companies you want to choose, this is a quick route to take.

Learn more about Exchange-Traded-Funds (ETFs) as well as Mutual Funds by checking out these other articles.

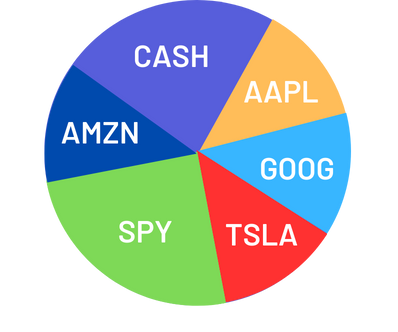

Asset Allocation

Asset Allocation means owning a variety of investments like real estate, stocks, bonds, gold/silver and cash. Yes, cash is an investment! For many years, the rule of thumb was to subtract your age from 100, and have that percentage of your overall value invested in stocks (so if you are 18 years old, you would invest 82% of your portfolio in stocks). The idea is that over time stocks have consistently outperformed other investments so the younger you are, the more you should be invested in stocks. As you get older and closer to retirement (when you will rely on your investments) you have less time and you would prefer the low but consistent returns of bonds and cash. Another way of putting this is that younger investors are more risk-tolerant and older investors are more risk-adverse.

This line of thinking is getting to be a little out-dated, with the rising popularity of ETFs, more choices for mutual funds, and the ability to invest in riskier bonds, but the idea of making your portfolio more risk-averse over time can still be a good idea.

Asset allocation is different from diversification – you might have a wide asset allocation, with almost no diversification!

For example, if you divided a $10,000 portfolio between 3 asset classes (Stocks, ETFs, and Mutual Funds), you could have the following holdings:

- Stocks: Celgene Corporation (CELG) and UnitedHealth Group (UNH)

- ETF: SPDR S&P Biotech ETF (XBI)

- Mutual Fund: Vanguard Health Care Fund (VGHCX)

You might be divided between 3 asset classes, but the entire portfolio is still concentrated on Healthcare/Biotechnology, so it is not diversified at all.

Building a Diversified Portfolio

Now that you understand the benefits of diversification and the different asset classes available, it’s time to build a diversified portfolio that’s tailored to your individual needs and goals.

Here’s a step-by-step guide to help you get started:

Step 1: Set Your Investment Goals and Risk Tolerance

Before you start building your portfolio, take time to define your financial goals and risk tolerance.

- What do you want to achieve with your investments?

- Are you looking to build your wealth over the long-term, or do you want to generate passive fixed income?

- What level of risk are you willing to take on?

Your investment goals and risk tolerance will guide all investment decisions as you create a personalized investment plan.

Step 2: Allocate Assets to Different Classes

A common approach is to allocate your assets based on your risk tolerance and the time you have left before you retire. With the goal of being able to live off your investments for a comfortable standard of living. So, you may start as an aggressive investor and become a conservative one later in life.

- Conservative investors: allocate 80% to bonds or fixed-income assets and 20% to stocks or high-growth assets.

- Moderate investors: allocate 40% to bonds or lower-risk assets and 60% to stocks.

- Aggressive investors: allocate 20% to bonds and 80% to stocks.

Step 3: Select Individual Securities or Funds Within Each Class

At this stage, you are actively researching and comparing your options to reduce exposure to any one particular security or sector. When selecting individual securities or funds, consider the following factors:

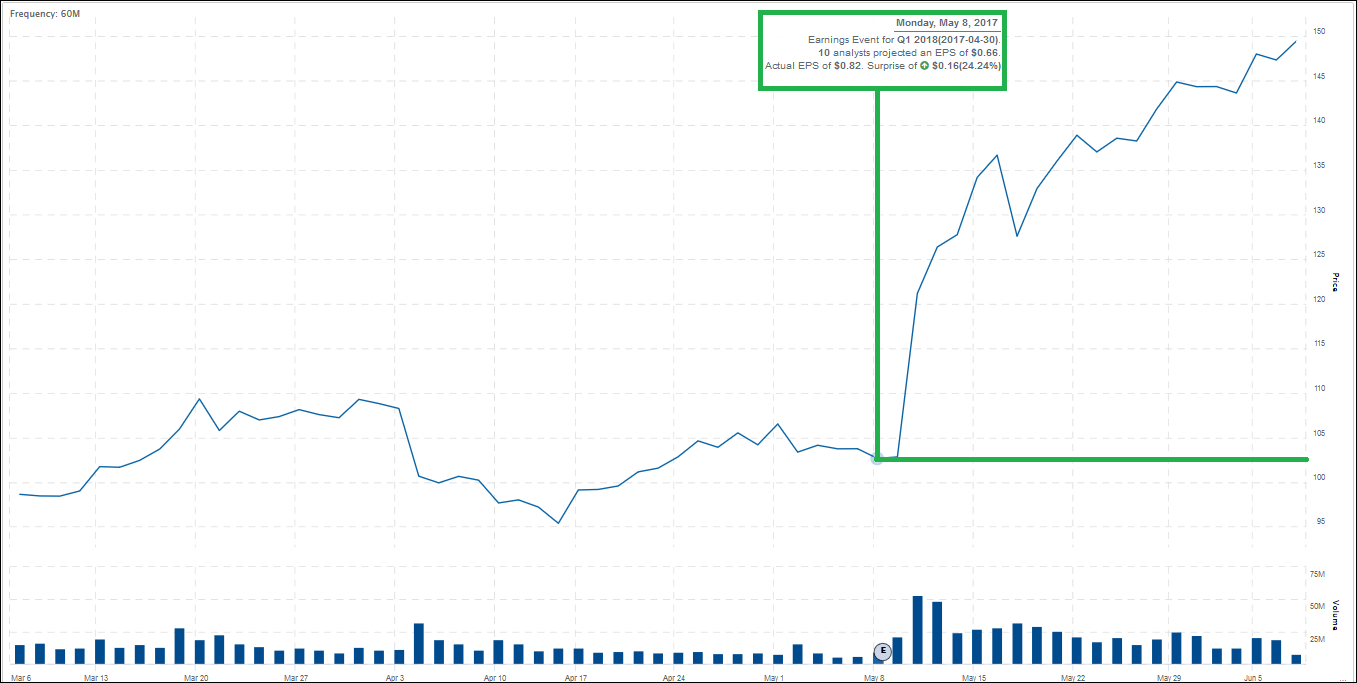

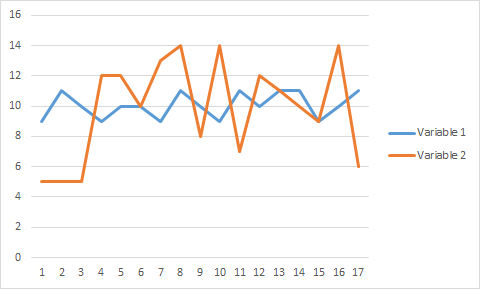

- Performance: compare the financial statements or price history between similar alternatives so you pick the best performing one for you.

- Risk: Consider the level of risk associated with each security or fund and ensure that it aligns with your risk tolerance.

- Fees: check what fees you will need to pay to minimize the impact on your returns.

As you make your selection, make sure your portfolio is diversified across different asset classes, sectors, and geographic regions.

Step 4: Rebalance Your Portfolio Regularly

Remember to take time either annually (or monthly) to re-evaluate your financial situation. Depending on your lifestyle or circumstances, you may need to adjust your investing plan. Rebalancing your portfolio can help you stay disciplined and focused on your investing goals, rather than making emotional decisions based on market fluctuations.

Advanced Diversification Strategies

While a well-diversified portfolio is essential for managing risk and achieving long-term success, there are several advanced diversification strategies that can help you further optimize your investment portfolio.

Sector Rotation

Sector rotation involves shifting your investments between different sectors or industries in response to changes in the market or economy. This can help you capitalize on opportunities in emerging sectors or industries, while avoiding those that are declining.

For example, if you’re invested in the technology sector and it’s experiencing a downturn, you may consider shifting your investments to the healthcare sector, which is experiencing growth.

Style Diversification

Style diversification involves investing in different styles or approaches within a particular sector or industry. This can help you balance out blind spots, for example if you are mostly following a buy and hold strategy, (where you intend to keep your investment 5+ years) you can allocate a portion of your portfolio to be actively managed. So you can take advantage of any short-term price fluctuations through day trading, value trading or another investing strategy.

Alternatively, within the technology sector, you may want to invest in both value and growth stocks. Value stocks are those that are undervalued by the market, while growth stocks are those that are expected to grow rapidly.

Geographic Diversification

As mentioned earlier in this article, geographic diversification involves investing in different regions or countries around the world. This can help you capture opportunities in emerging markets, while managing risk.

For example, you may want to invest in emerging markets such as China or India, which are experiencing rapid growth. While also staying invested in developed markets such as the United States or Europe, which are more stable.

Alternative Investment Diversification

Alternative investments involve investing in assets that are not traditional stocks or bonds, such as private equity, cryptocurrencies, hedge funds, or real estate.

For example, you may want to invest a small portion of your portfolio in a private equity fund that invests in small businesses or startups. Or, you may want to invest in Bitcoin, Ethereum or other cryptos to get exposure to this new market.

Keep in mind these are more advanced strategies for a reason, before dabbling with any of them, get to know how well you respond to risk. The rewards of potentially earning a higher return may not be worth the stress of trying to manage complex financial instruments.

Common Mistakes to Avoid

Over- or Under-Allocating to a Particular Asset Class

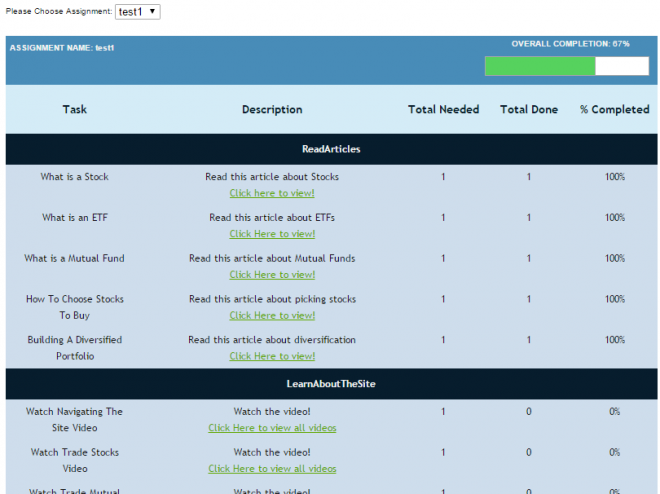

One common mistake is to over- or under-allocate to a particular asset class. This can lead to a portfolio that is too concentrated in a single asset class, which can increase your risk. Diversifying is good, but don’t go too far! If you start diversifying too much, your portfolio starts to get thin. You might not lose much if one company starts to go down, but you also won’t gain much if another company you own starts doing very well. Beginners should usually build their first portfolio on HowTheMarketWorks with between 8 and 10 stocks, ETFs, or Mutual Funds at a time. You can always switch the investments you have, but try to avoid having too many, or two few, investments at once.

Over-Diversification can also make it more difficult to manage your investments. If you’re not able to follow-up with company news and stay on top of your investments, things could start turning bad, and you could start losing one before you even know why!

Ignoring Inflation Risk

Another common mistake is to ignore the risk of inflation. Inflation erodes your purchasing power, and the value of your investments over time. If your portfolio is heavily weighted towards fixed-income investments (bonds), or you’re keeping most of your money in cash or cash equivalents, you will be exposing yourself to significant inflation risk. As you develop your investing strategies, keep in mind that your rate of return needs to be above the rate of inflation, or else your portfolio is going down in value in real terms.

Failing to Rebalance the Portfolio Regularly

Finally, failing to rebalance your portfolio regularly is a very common mistake. Think of it like spring cleaning, but instead of taking everything out of the closet to see what you want to giveaway, you are evaluating whether you want to sell-off some of your investments instead. If you make a habit of reviewing each asset you’re holding, you’ll also be able to spot opportunities you may otherwise miss.

For example, a company you own received some bad press, so the stock price went down. You review their financial statements and discover the negative market sentiment, in the other words the attitude or feeling of other investors, does not line up with the real value of the company. You decide to buy some more shares and make a short-term gain.

Summary

Learning how to diversify your portfolio is all about creating a more stable and resilient portfolio that can withstand market fluctuations. If you’re ready to start building a diversified portfolio, here are some final thoughts to keep in mind:

- Start small and gradually increase your investments as you become more comfortable with the process.

- Don’t be afraid to ask for help or seek advice from a financial advisor if you’re unsure about any aspect of the process.

- Be patient and disciplined and remember that diversification is a long-term strategy that requires time and effort to achieve.

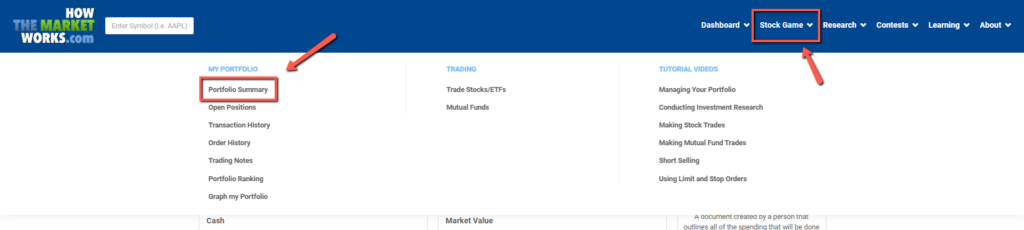

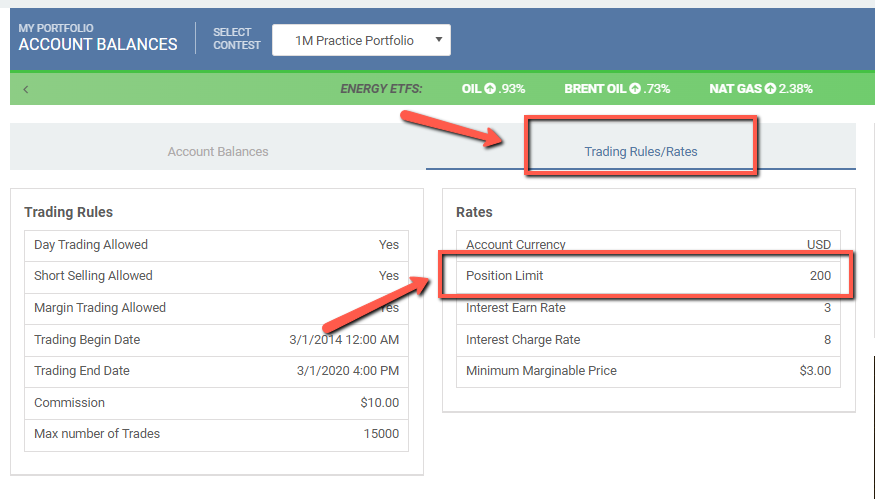

And finally, we invite you to start building a diversified portfolio today on HowTheMarketWorks, a platform that allows you to test out your investing strategies before using real money.

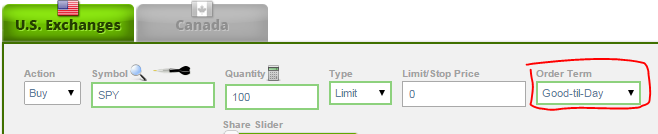

To get started building a diversified portfolio, identify five sectors from the image above that you are interested in. From each of those 5 sectors, pick one stock that you are familiar with. Determine the tickers for those stocks, get quotes, review their charts, make sure those stocks are on upward trends, and then buy those stocks in your virtual account. If you started with $100,000 then invest about $10,000 in each of those 5 stocks. Don’t be afraid, it’s only play money and you need to jump in and start learning how the market works.

So what are you waiting for? Start building a diversified portfolio today and take the first step towards achieving your financial goals!

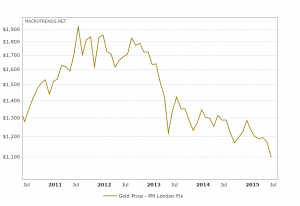

Today, the price of gold has plummetted to almost half the peak, mining companies are losing money, and the overall price crash is starting to spread to copper, tin, and aluminium.

Today, the price of gold has plummetted to almost half the peak, mining companies are losing money, and the overall price crash is starting to spread to copper, tin, and aluminium.