Contest: Official September Contest

Final Rank: 5

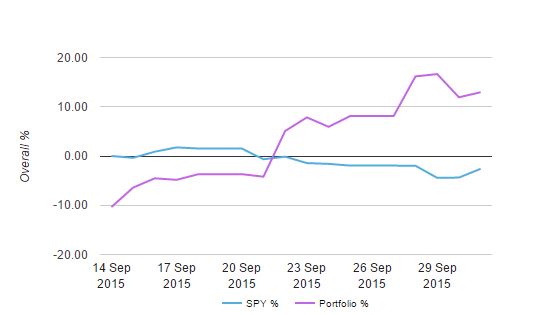

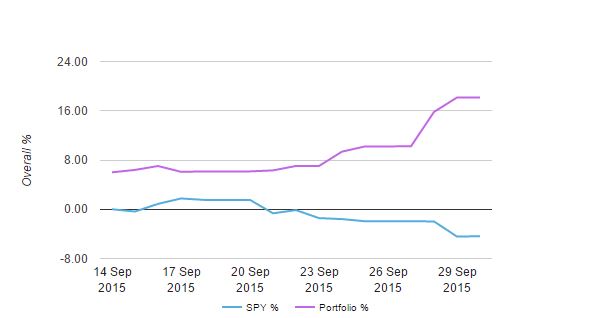

Final Portfolio Value: $1,119,202.95 (+11.19%)

Trading Strategy For This Contest

My strategy is to look for stocks to short that are moving up (30% +)on news with greater than average volume. So much of the time people get overly excited about the news and drive the price higher and higher. Low float stocks have this happen quite often, an example of this today would be NSPR.

They just did a 1 for 10 reverse split, October 1st, which in itself gives me good reason to short it. They reduced their outstanding shares from 78,000,000 to 7,800,000, float is 7,000,000. Today the share price went from $1.42 a share to $2.12 at its high (a 55% increase), on 13 times its average volume. If you were

watching and lucky enough to short at the high you could have made some money today. A patient person could still make money, I believe it moved up in anticipation of a presentation their Chief Executive Officer, Alan Milinazzo, will give at the Dawson James Securities Growth Stock Conference

on October 15, 2015, other than that there was no reason for the move. When I see something that looks like a possibility, I’ll go read the news. If I decide that the news does not merit the kind of move the stock has made, I’ll check the float, volume, chart, revenue,

debt, if it all checks out I’ll take a short position. My thinking is that if a good return is 7-10% a year when I see a stock up 30, 50,100% or more in a day that’s irrational exuberance. It might not come down that day but it will come down.

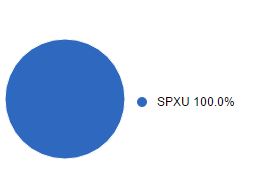

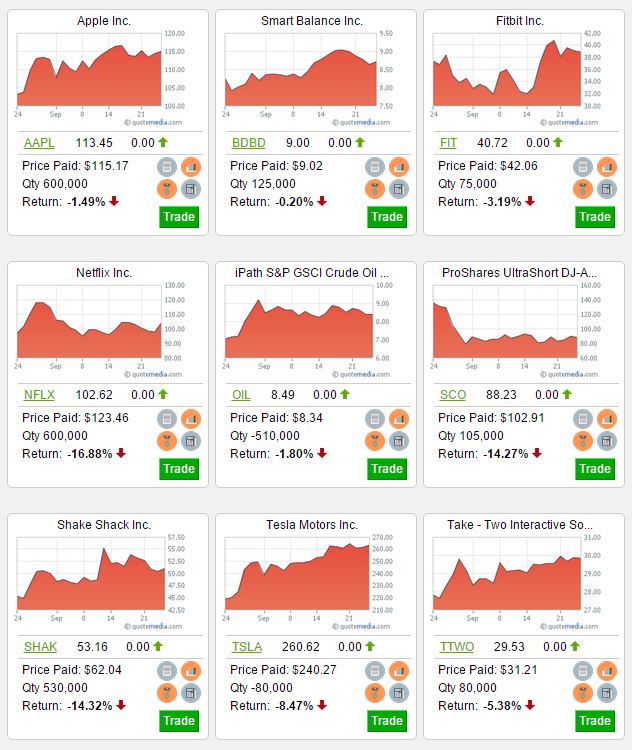

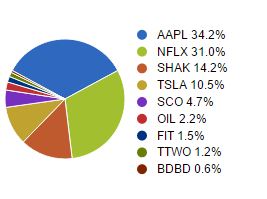

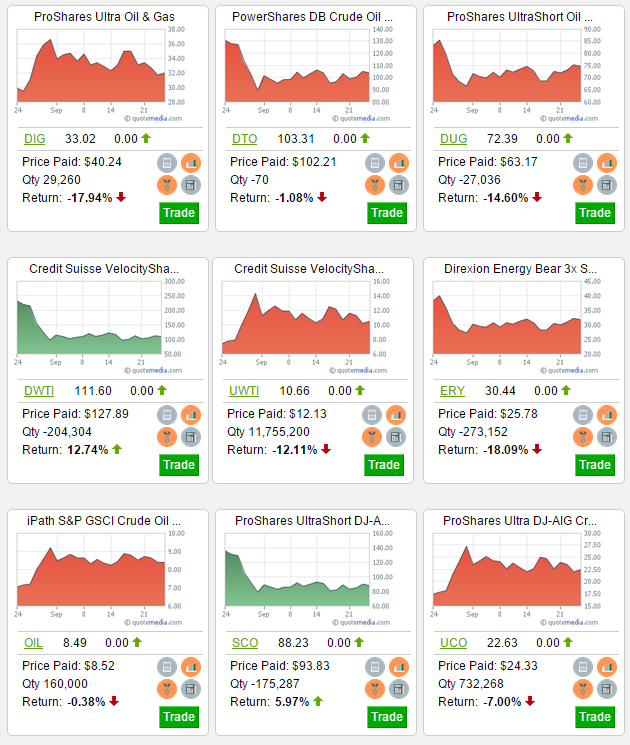

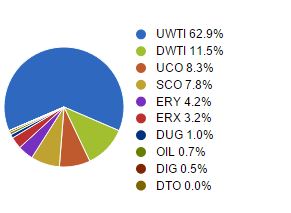

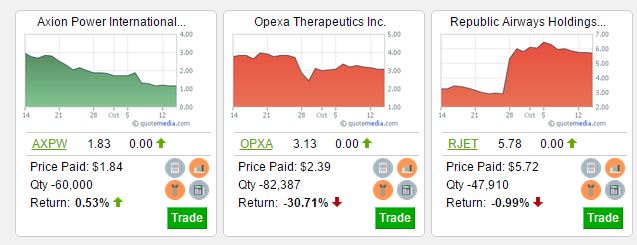

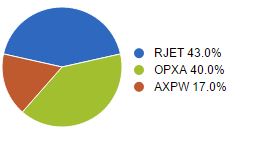

Final Open Positions and Portfolio Allocation

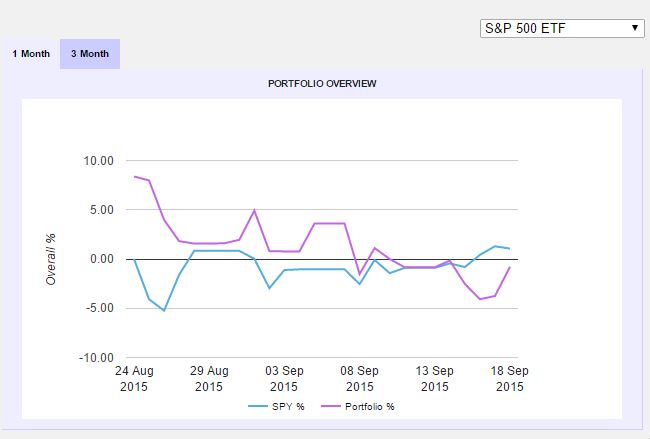

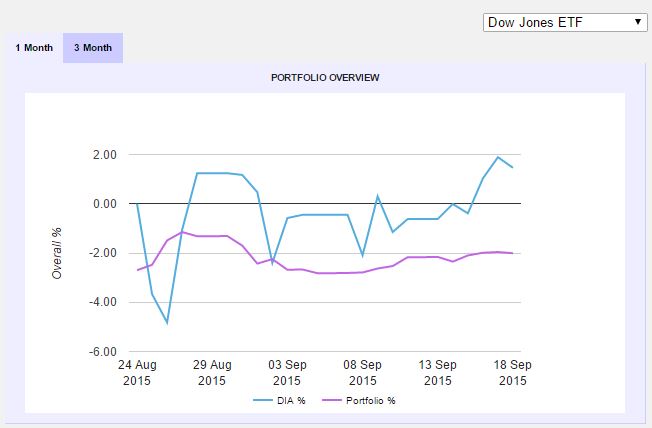

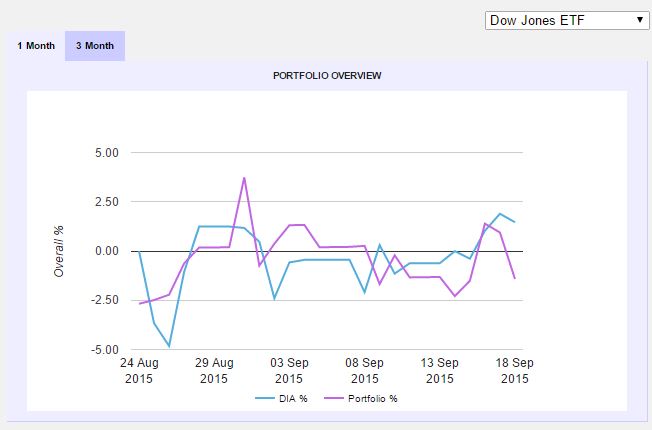

Performance Over The Total Contest

Budgeting is perhaps the most essential skill a person can have as they begin living on their own. Whether it is the simple act of balancing a check book, managing bank accounts, or deciding whether it is time to buy or rent, building a budget is the basic core of personal finance. Browse this collection of lesson plans, and find great ways to incorporate HowTheMarketWorks!

Budgeting is perhaps the most essential skill a person can have as they begin living on their own. Whether it is the simple act of balancing a check book, managing bank accounts, or deciding whether it is time to buy or rent, building a budget is the basic core of personal finance. Browse this collection of lesson plans, and find great ways to incorporate HowTheMarketWorks!