Every year or two, most of us go to the doctor’s office to receive a check-up on the state of our physical health. The doctor typically checks several measurements (height, weight, blood pressure, etc.) in order to gauge how our health has progressed over the past year. They can then use their results to determine if there is any immediate threat to our well-being or to make helpful recommendations (“you seem to have gained 45 pounds, sir; I suggest you go on a diet”).

Just like we all care about our personal health, managers and investors care about the health of their company. How can they perform a “check-up” on their business in order to determine its progress and financial health? Instead of weight or blood pressure, analysts use financial ratios. We’ll talk about three categories of ratios: profitability, liquidity, and solvency.

Profitability

When a company sells goods or provides services, the money they receive from customers comes in as sales (the terms revenue and sales are interchangeable). However, before they can put it in the bank, there are always expenses that the firm has to pay—wages for employees, marketing costs, taxes, and many more. Profitability ratios examine what’s left over after paying off those expenses. With each of the following metrics, a higher number is better because it means less money going out for expenses and more retained as profit.

Gross Margin

Gross Margin = (sales – cost of goods sold) / sales

Gross margin compares the first two lines on the income statement: sales and cost of goods sold. Cost of goods sold is the amount a company spends to obtain the goods they are selling. Let’s say I own a hat company. My cost of goods sold would be the money I spend either buying the hats from a supplier or on the materials and direct labor necessary to produce them myself. For many companies, cost of goods sold is the largest expense.

The main insight we can gain from gross margin is a look at the strength of our relationship with suppliers. If I’m earning a 50% gross margin on my hat business but a rival firm that sells the exact same hats gets a 60% gross margin, I am doing something wrong. I likely need to either renegotiate or find a new supplier that can provide the goods that I need at a cheaper price. A gross margin below industry average is a bad sign for a company and indicates a potential long-run competitive disadvantage.

Operating Margin

Operating Margin = (sales – cost of goods sold – operating costs) / sales

This ratio simply builds upon the gross margin, this time also subtracting out operating expenses. Operating expenses are anything that is involved with the operations of the firm; this commonly includes selling and administrative expense, research and development, and depreciation.

Operating expenses are one area that managers have a greater amount of control through strategic choices they can make. Their goal is to keep operations as lean and efficient as possible by maximizing output from each employee, limiting unnecessary outflows, and tactically designing marketing and R&D spending policies that perform effectively without bleeding the company dry of profits. Managers are often compensated based upon their ability to cut operating costs.

Net Margin

Net Margin = net income / sales

Net margin gets right down to the most important detail—what amount of our sales are we able to take to the bottom line? To reach net income, we have to subtract out interest expense and income taxes from our previously calculated operating margin.

When comparing companies, net margin is one of the most essential metrics to judge a firm by. Companies that are able to keep greater percentages of their sales as earnings will bring in more money in good times and will be more likely to keep a positive net income in tough economic times. If my hat shop has a healthy 15% net margin and my competitor is at 2%, odds are that in tough times (say, when people are buying less hats and we have to lower prices to drive sales) my earnings will hold up better than the rival, who could quickly shift to actually losing money.

Liquidity

Whereas those profitability ratios focused on income statement items, liquidity and solvency are mainly concerned with the strength of a company’s balance sheet. The concept of liquidity centers upon a business’s ability to handle short-term obligations like accounts payable, accruals, and debt that is due within one year.

Short-term liabilities aren’t a bad thing— nearly every company needs to use them to operate—but managers must make sure there is enough cash around to handle them. If $200 million is due in a month and we only have $50 million available to pay it, our company needs to scramble to collect or borrow an additional $150 million or we could go into default. Defaulting is a disaster for companies and can lead to a credit downgrade, higher interest rates, or even bankruptcy if creditors are alarmed and want their money back faster.

To ensure our business avoids such unpleasantries, we need to keep an eye on liquidity ratios.

Current Ratio

Current Ratio = current assets / current liabilities

This is a simple calculation as both current assets and current liabilities are added up for us on the balance sheet. However, it is important to make sure that the current ratio doesn’t dip too low—a higher number is better as it means we have more liquid assets available to counteract our short-term obligations. A current ratio of 2 or higher is often seen as “safe”, but that number varies depending on the company.

The problem analysts should watch for is a major drop in current ratio between one period and the next. If my hat business has a current ratio consistently around 2 from 2012-2016 but this drops to 1.2 in 2017, it could mean something is going very wrong. We may have borrowed too much money, customers might not be paying us on time, or we may have spent too much of our cash reserves on a long-term asset (such as a new factory). As long as the problem is caught early enough, there is usually a way to raise short-term funds through long-term financing and ensure that the business isn’t going to run into any liquidity problems.

Quick Ratio

Quick Ratio = cash and cash equivalents / current liabilities

The quick ratio tells us similar things to the current ratio, except it only includes cash and cash equivalents (which can include money market accounts, short-term securities, or anything else we can quickly turn into cash). The point of this is that current assets besides cash (like accounts receivable and inventory) are riskier than cash itself. If we owe the bank $10 million in a month, they won’t accept $10 million in hat inventory. We would have to hope we can sell that inventory to raise cash, which is not a certainty by any means. Again, a big drop in the quick ratio is the main problem an analyst would want to watch for.

Solvency

Solvency ratios are focused on looking beyond the short term and determining how a company is financially positioned to survive in the long term. This mostly looks at how much long-term debt a business is holding relative to other accounts and the amount of interest expense a firm is shelling out every year.

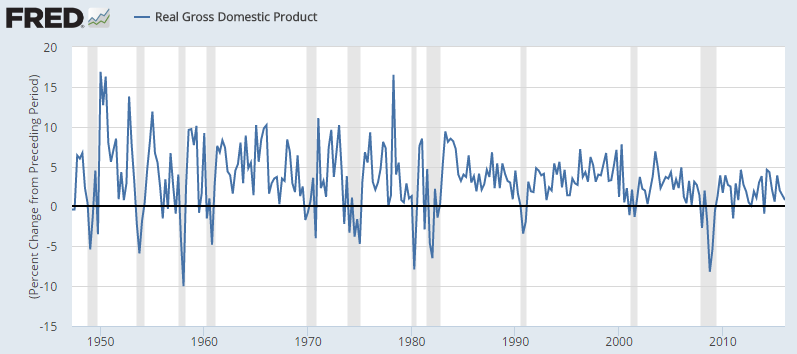

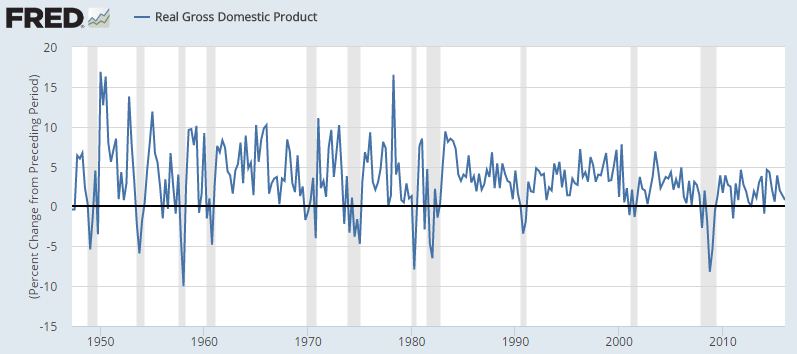

The stakes are high here. If our company has too much debt and has to spend too much on interest, we are going to go bankrupt. The economic cycle is very important to keep in mind, because what may be an ok amount of debt in good times can quickly turn into way too much in a recession. It’s the analyst’s job to think ahead and make sure that if there’s a downturn and our earnings drop off, we are positioned to survive.

Debt-To-Equity Ratio

Debt to Equity = Total Liabilities / Total Equity

This is one of the most common solvency ratios that analysts use. Essentially, it shows us a comparison between the amount of debt financing (borrowing) that we use versus the amount of equity financing (for example, selling common stock). Generally speaking the lower this ratio is, the safer the company’s balance sheet. Debt to equity varies widely depending on the company and the industry.

The most useful thing we can do is compare debt/equity ratios across an industry. If the average debt/equity in the hat industry is 1 (equal use of debt and equity) but my business is running at 3.5, there’s a good chance that in a downturn my company will be the first to go bankrupt. Alternatively, if a company has had a debt/equity of 0.5 for the past five years but in 2017 it leaps to 2, investigation needs to be done as to why so much debt was added and whether or not the business can handle it.

Interest Coverage

Interest Coverage = earnings before taxes and interest (EBIT) / interest expense

This is a really useful ratio to see how well a company can handle their interest payments. It tells us how many times we can cover our interest expense (found on the income statement) using our EBIT or operating income. The higher the ratio, the more comfortably we are managing our interest. A major drop-off in the interest coverage ratio means that either we’re earning less or paying out more interest—either is concerning!

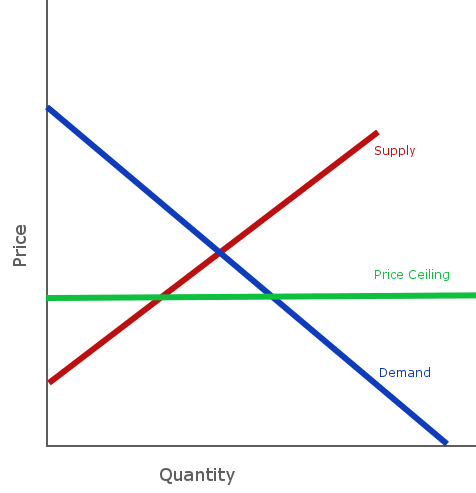

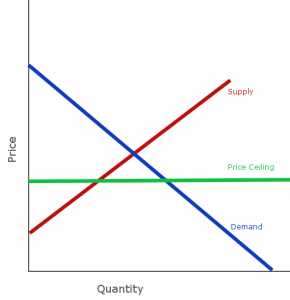

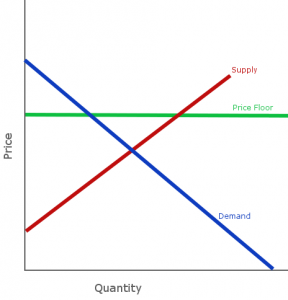

Price Ceilings are controls put in place to prevent the price of some good or service from getting too high. This type of control is most common with food, where there might be a maximum price that businesses can charge for things like flour or electricity.

Price Ceilings are controls put in place to prevent the price of some good or service from getting too high. This type of control is most common with food, where there might be a maximum price that businesses can charge for things like flour or electricity. Price Floors are the opposite – a control put in place to ensure that a certain amount of something is produced by making sure producers are guaranteed at least a certain price for what they supply. These types of control are common for milk.

Price Floors are the opposite – a control put in place to ensure that a certain amount of something is produced by making sure producers are guaranteed at least a certain price for what they supply. These types of control are common for milk.

Types:

Types: