Meet the Dogs

No question about it, investing is a dog-eat-dog world. Traders are constantly developing and revising strategies in order to make the most money in the stock market. Throughout time many strategies have come and gone, few sustaining any significant longevity.

However, over the past decades, Michael O’Higgins’ strategy coined “Dogs of the Dow” has built a reputation as a relatively easy and dependable long term investment strategy.To understand the Dogs of the Dow, first you need to familiarize yourself with the Dow Jones Industrial Average. Created in 1896 by Charles Dow, the “Dow” is an index that tracks the performance of the 30 largest NYSE and NASDAQ companies. Since its inception, the Dow Jones has become arguably the most popular index and is the most common metric for measuring the overall health of the U.S stock market.

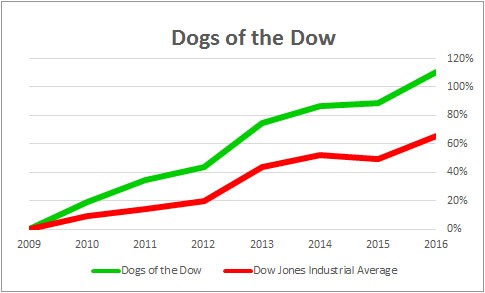

Recognizing the how synonymous the Dow was with the performance of the broader market, O’Higgins sought out a strategy that would “beat the Dow.” In his mind, if you were beating the Dow then you were also beating the market, every investor’s ultimate goal.

After some experimentation, O’Higgins settled on a simple set of steps. At the end of each year, calculate the dividend yields of each of the 30 Dow Jones’ stocks. Select the 10 stocks with the highest dividend yields and invest equal amounts in each of them. Hold the stocks and collect their dividends until year end and then repeat the process. Simple enough, right?

So, if we do the calculations as of June 30, 2018, here is the Dow 30 ranked by dividend yield. The top 10 would be O’Higgins’ “Dogs”.

Dogs of the Dow (June 30th, 2018)

| Stock Symbol | Company Name | Dividend Yield | Closing Price | Annualized Dividend |

| VZ | Verizon | 4.65% | $50.75 | $2.36 |

| IBM | IBM Corp | 4.21% | $149.24 | $6.28 |

| XOM | Exxon Mobil | 4.00% | $82.01 | $3.28 |

| CVX | Chevron Corp | 3.68% | $121.67 | $4.48 |

| PG | Procter & Gamble | 3.64% | $78.73 | $2.87 |

| PFE | Pfizer | 3.64% | $37.36 | $1.36 |

| KO | Coca-Cola Co. | 3.46% | $45.11 | $1.56 |

| CSCO | Cisco Systems | 3.11% | $42.40 | $1.32 |

| MRK | Merck | 3.07% | $62.51 | $1.92 |

| JNJ | Johnson & Johnson | 2.86% | $125.94 | $3.60 |

| WBA | Walgreens Boots Alliance, Inc. | 2.71% | $64.93 | $1.76 |

| MMM | 3M | 2.70% | $201.60 | $5.44 |

| MCD | McDonald’s | 2.57% | $157.41 | $4.04 |

| CAT | Caterpillar Inc. | 2.47% | $139.42 | $3.44 |

| TRV | Travelers Co. | 2.46% | $125.18 | $3.08 |

| WMT | Wal-Mart Stores | 2.37% | $87.72 | $2.08 |

| INTC | Intel Corp | 2.31% | $51.98 | $1.20 |

| DWDP | DowDuPont Inc. | 2.30% | $66.14 | $1.52 |

| UTX | United Technologies | 2.15% | $130.36 | $2.80 |

| JPM | JP Morgan Chase | 2.04% | $109.89 | $2.24 |

| HD | Home Depot | 2.03% | $202.63 | $4.12 |

| BA | Boeing Co. | 1.92% | $355.33 | $6.84 |

| MSFT | Microsoft | 1.61% | $104.40 | $1.68 |

| AAPL | Apple Inc. | 1.52% | $191.88 | $2.92 |

| DIS | The Walt Disney Company | 1.50% | $112.13 | $1.68 |

| UNH | UnitedHealth Group | 1.42% | $252.93 | $3.60 |

| AXP | American Express | 1.40% | $100.17 | $1.40 |

| GS | Goldman Sachs | 1.39% | $229.63 | $3.20 |

| NKE | Nike Inc. | 1.04% | $76.95 | $0.80 |

| V | Visa | 0.60% | $140.13 | $0.84 |

For clarification, a company’s dividend yield is the ratio of its dividend to share price. O’Higgins chose to select by dividend yield because he believed that Dow stocks set their dividend amounts based on the average worth of their company. This idea, paired with the idea that share price moves according to where a company stands in the business cycle, means that a high dividend to low share price ratio creates a perfect opportunity for investment. In other words, a high dividend yield communicates that a firm has high worth and a high potential for growth.

Of course, this model is based on several key assumptions, but over time his strategy has consistently outperformed the Dow. It has proved to be an accessible and reliable model, perfect for new investors and long term traders. If you’re looking to get started in the stock market but don’t know where to begin, consider the Dogs of the Dow strategy. After all, numbers don’t lie.

5 Stocks to Buy Now

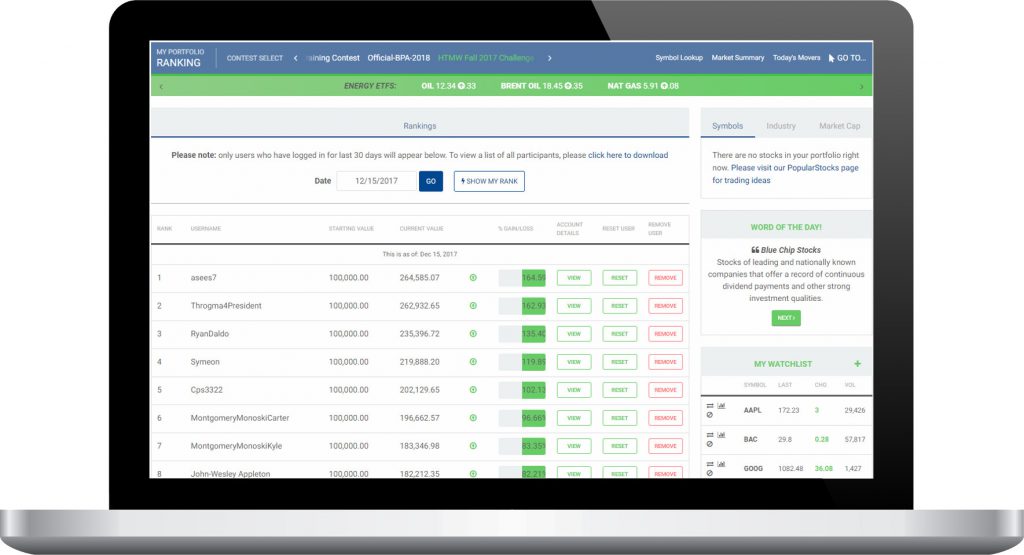

If you wanna get your feet wet with the Dogs of the Dow strategy, use your Wall Street Survivor account to buy Verizon, IBM, Exxon, Chevron, and Procter & Gamble. Try it out for size and, when year end comes around, think about using this strategy to start building your real stock portfolio!

It has often been said that debt is one of the ugliest four letter words on the planet. Truth be told, the biggest empires have been built on debt-fueled financing. All big-ticket purchases require credit approval. These expense items include things like homes, college education, vehicles, exotic vacations, et al. Without loan approval, none of these things is possible for the typical US household. The problem is not so much debt; it’s one’s ability to meet these financial commitments.

It has often been said that debt is one of the ugliest four letter words on the planet. Truth be told, the biggest empires have been built on debt-fueled financing. All big-ticket purchases require credit approval. These expense items include things like homes, college education, vehicles, exotic vacations, et al. Without loan approval, none of these things is possible for the typical US household. The problem is not so much debt; it’s one’s ability to meet these financial commitments.